I have been invited to deliver talks at the Bank of England, the LSE Investment Society, and have been a longstanding contributor to ‘Freedom Week’ hosted by Sidney Sussex College, Cambridge.

I have delivered the following lectures many times:

- An Introduction to the Austrian School of Economics – the past, present and future of good economics

- Competition and the market process – why the best form of regulation is competition

- The financial crisis – a look at the incentive and knowledge problems that led to the credit crunch

- Banking reform and sound money – a proposal to liberalise the banking system

- Economic institutions and global prosperity – an overview of the economic policies that are crucial to prosperity

- The transition experience in Eastern Europe – why radical reforms are necessary and the underappreciated role of the oligarch

“The Economics of Football“, BIM Open Day, ESCP Business School, London (April 2021)

“Reflections and Advice on Higher Education” CASE Belarus, Minsk (June 2018)

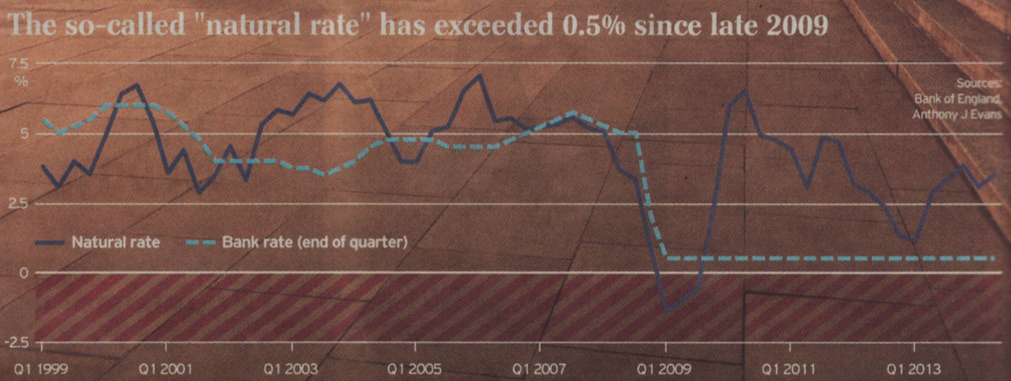

“The Importance of Austrian Economics for Central Banks” Bank of England (July 2017)

“How I teach” Brian’s Last Friday Talks, London (January 2017)

”How free markets can handle money” European Students for Liberty, Ljubljana (October 2016)

“The link between economic institutions and global prosperity”, Legatum Institute (July 2016)

“Free market monetary theory and practice”, Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2016)

“Why you should love price discrimination!“, Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2016)

“Hayek and Friedman in Chile”, Brian’s Last Friday Talks, London (June 2016)

“Is there a libertarian case for QE?” Libertarian Alliance, London (June 2016)

“An Introduction to the Austrian School of Economics”, UCLU Libertarian Society, London (February 2016)

“An Introduction to the Austrian School of Economics“, Libek and ESFL, Belgrade (January 2016)

“An Introduction to the Austrian School of Economics“, Regional Conference of ESFL Vienna (November 2015)

“Free market monetary theory and practice” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2015)

“Competition and the market process” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2015)

“Free market monetary theory and policy” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2014)

“Competition and the market process” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2014)

“Individual Actions: An Austrian Economics School”, University of Essex Liberty League & Post-Crash Economics Society Essex (April 2014)

“Monetary laissez-faire” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2013)

“Competition and monopoly” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2013)

“We had it coming: Introduction to Austrian Economics” FEE Webinar (April 2013)

“Only Individuals Choose”, The Adam Smith Institute’s ‘Liberty Lectures’, Cass Business School, London (August 2012)

“The financial crisis” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2012)

“Competition and monopoly” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2012)

“An Introduction to the Austrian School of Economics” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2012)

“An introduction to the Austrian school of economics” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2011)

“The financial crisis” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2011)

“Competition and monopoly” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2011)

“A Proposal for Sound Money” Libertarian Alliance, London (November 2010) [video here]

“Thoughts on the US Economy: September 2010” Charles G. Koch Charitable Foundation (September 2010)

“Banking, inflation and recessions” The Adam Smith Institute’s ‘Liberty Lectures’, Cass Business School, London (August 2010) [event details]

“Booms, busts and crashes: What Austrian economics tells us about the crash of 2008” Institute of Economic Affairs, London (July 2010) [event details]

“Competition and Monopoly” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2010)

“The Financial Crisis” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2010)

“The Investment Climate of Transition: Shock Therapy in Eastern Europe” LSE Investment Society (February 2010)

“Banking, Honest Money and the Free Market: Prospects” Libertarian Alliance Annual Conference, London (October 2009) [see video here]

“Honest Money in a Free Society” Libertarian Alliance, Shepherd’s Private Room, Westminster (July 2009)

“Competition and Monopoly” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2009)

“The Financial Crisis” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2009)

“Austrian Insights into the Current Economic Crisis – What Might have Been?” University of Oxford Libertarian Society, Christ Church, University of Oxford (February 2009)

“Some stylised facts about Eastern European transition” University College London (November 2008)

“Advice for an international business education” Management Development Institute, Gurgaon, India (October 2008)

“Transition economies: lessons for classical liberals” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2008)

“Competition and the Market Process” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2007)

“Collective Goods Problems” Freedom Week Seminar, Sidney Sussex College, Cambridge (July 2007)

“Do Ideas Matter?” Hayek Society, London School of Economics (November 2006)

I’ve also rejected invitations to debate at the Cambridge Union Society, and Lancaster Debating Union.

The course introduces students to several important and contemporary issues that relate to economics. Having already covered the key insights from Micro and Macroeconomics, we will go deeper into the frontiers of the discipline. Students will challenge their understanding of complex and controversial issues and develop their perspective on how to become managers of the future.

The course introduces students to several important and contemporary issues that relate to economics. Having already covered the key insights from Micro and Macroeconomics, we will go deeper into the frontiers of the discipline. Students will challenge their understanding of complex and controversial issues and develop their perspective on how to become managers of the future.