Inequality

| Activity: Thinking about wealth |

| Lecture handout: Inequality* |

⭐ Required readings:

- Saez, E., and Zucman, G., 2020, “The Rise of Income and Wealth Inequality in America: Evidence from Distributional 2 Macroeconomic Accounts” Journal of Economic Perspectives, 34(4):3-26

Watch: $456,000 Squid Game in Real Life

Watch the full movie Parasite (2019), Bong Joon Ho

Many consider inequality to be a key social problem, and yet economics is all about delving beyond intuitions. Do we have good data on what has happened to inequality over time? What type of inequality matters? Is there an important trade-off to consider when confronting inequality? The answers to these questions may be controversial, but they are relevant and important.

Here is a thread containing 10 books about inequality:

10 Great books on Economic Inequality

1) Inequality – Tony Atkinson Absolutely THE book on inequality and what can be done about it. Atkinson was a giant in the profession and this book reflects this, the length-insights ratio of this book is amazing. pic.twitter.com/Vf0W21VurM— Michael Thrower (@BevansAdvocate) November 29, 2023

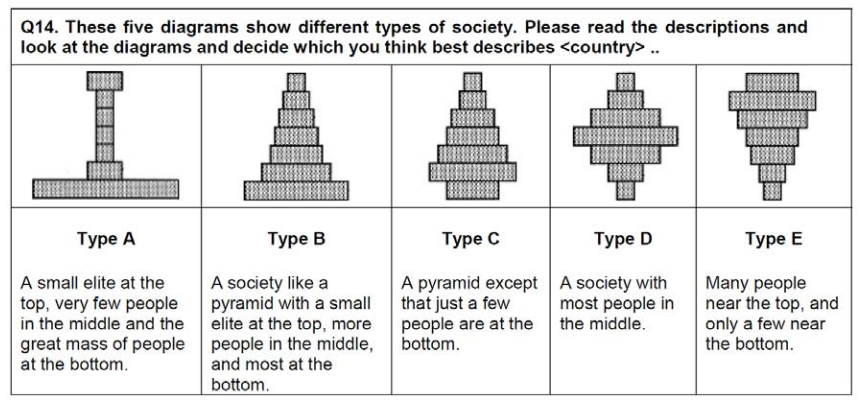

Imagine trying to answer the following question:

A study by Gimpelson and Treisman (“Misperceiving inequality“, NBER Working Paper 21174) found that:

- In 29 of the 40 countries a majority of respondents who ventured a guess guessed wrong.

- In 29 countries, the leading choice attracted fewer than 50 percent of those who guessed.

- In almost three quarters of countries, most respondents who thought they could identify the general pattern of inequality got it wrong.

loads of the objections people have to inequality, if there is any truth to them, are probably actually objections to perceptions of inequality, which may be more driven by media coverage than reality. If that’s true, then trying to reduce inequality in fact is a waste of time — you should try to get the media to talk about it less instead

My view of the inequality debate is informed by “Fast” Eddie Felson, from ‘The Hustler’,

Vincent Geloso has challenged some of the work done by Gabriel Zucman. You can read more here:

Thread: Let us be clear — the work of Gabriel Zucman should be taken with a major/huge grain of salt. Largely because he and his colleagues have been sloppy as hell. I will not mince words here and list the litany of sloppiness #econtwitter https://t.co/4icOSMcZc7

— Vincent Geloso (@VincentGeloso) June 16, 2023

and here:

Okay, I had the time to read this over. In the past, I did not mince words much. I do not see the reason to do any mincing now.

There are six replies that must be made to this piece.

First: Zucman (I am assuming he also speaks for the other two musketeers) is… https://t.co/SldXUFXZU7 pic.twitter.com/tGksxSHcxb

— Vincent Geloso (@VincentGeloso) December 17, 2023

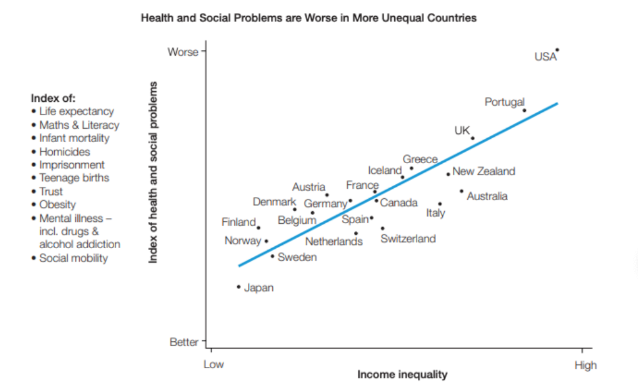

I’ve often seen students link to this graph:

On initial inspection this graph looks highly dubious:

- The selection of countries is suspicious (why exclude countries that have more income inequality than the US, and why include Finland but not Singapore?)

- The “Index of health and social problems” looks arbitrary and prone to manipulation

However I’ve not been able to find the actual source yet. I assume it comes from ‘The Spirit Level‘, which I believe has been quite firmly debunked.

Oxfam are also renowned for using dodgy statistics. For example:

-

Oxfam serves up a lot of dodgy statistics, by Noah Smith, June 15th 2022

Aside: Sometimes I’m asked what I really think about inequality. Really? That the there is no ethical basis for being concerned about inequality per se. In fact, the best argument to take it seriously is because low educated and xenophobic natives, who have hit the jackpot in where to be born, hold civilised (i.e. cosmopolitan) society to ransom by threatening extremism of various sorts and civil disorder unless their concerns are met. Ideally, we prevent all that from happening by ensuring nominal income stability and productivity growth. But there’s no moral basis for “equalising” arbitrary distributions. Our moral concerns should be focused on eradicating poverty and destitution; and ensuring a competitive market economy that rewards wealth creation and limits rent seeking. If forcing Charles Koch to emigrate improves your metrics of success, then I demur.

For more on Mr Beast see this twitter thread and this interview with Joe Rogan:

Or this one with Lex Fridman:

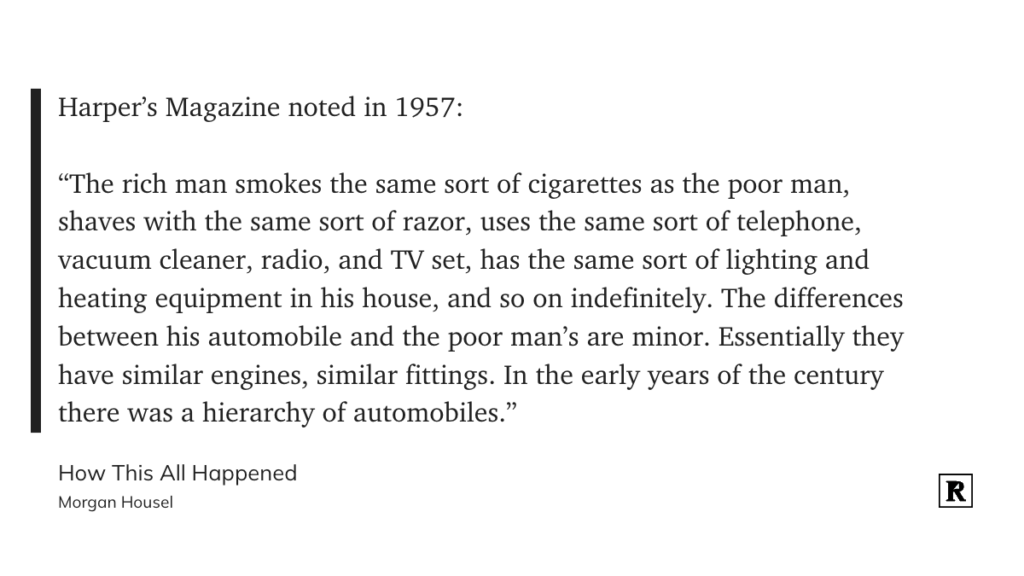

The lecture tried to show the link between economic growth and rising living standards for the general public.

It's crazy to me that a college student and a billionaire own basically the same phone and laptop.

For all the inequality in the world, access to tech in the developed world is a remarkably level playing field.

— Nathan Barry (@nathanbarry) November 19, 2021

This is also something that Dracula noticed when he encountered a “normal” modern house:

I’ve been a nobleman for 400 years. I’ve lived in castles and palaces among the richest people of any age. Never….never! Have I stood in greater luxury than surrounds me now. This is a chamber of marvels. There isn’t a king, or queen or emperor that I have ever known or eaten who would step into this room and ever agree to leave it again. I knew the future would bring wonders. I did not know it would make them ordinary.

Similarly, see this quote:

A key point from the lecture is that when assessing inequality it is important to look at consumption (or living standards) as well as income and wealth. In this post Scott Sumner makes the case for why the only sensible way to look at inequality is through consumption.

Wealth tax

In January 2022 a group of high net worth individuals signed a petition to campaign for a wealth tax. Here is an overview and discussion of a wealth tax:

Here is a debrief about the wealth tax quiz. Recently, Norway increased their wealth tax to 1.1%. According to a report in The Guardian, “More than 30 Norwegian billionaires and multimillionaires left Norway in 2022… This was more than the total number of super-rich people who left the country during the previous 13 years, it added. Even more super-rich individuals are expected to leave this year because of the increase in wealth tax in November, costing the government tens of millions in lost tax receipts… Many have moved to Switzerland, where taxes are much lower”

Here is a KPMG report on how Switzerland treats Cryptocurrencies as part of its wealth tax.

Here is the reason I’m concerned about the link between inequality as a public policy issue and central bank digital transformation:

We realize it’s difficult to pay your wealth tax when much of your wealth is in the form of illiquid assets. As a result, we’ve deducted the amount from your CBDC balance, which is now negative and subject to the central bank’s borrowing rate.

— Josh Hendrickson (@RebelEconProf) February 21, 2022

Universal basic income

A universal basic income is a policy programme that provides all citizens with a specified amount of money irrespective of need. This Vox article provides a good summary of different examples of how they work in practice. In 2023 the UK trialled a scheme paying £1,600 per month.

I largely share Martin Wolf’s (2023, p. 283) criticisms of a universal basic income (UBI) in that by being so intentionally ill targeted it creates too much of a waste of limited public funding – “A UBI at a high enough level to render targeted assistance to those who are vulnerable, needy, and deserving would be unaffordable, while a UBI that is affordable would benefit many people who do not need the money and fail to benefit important services and people who need more than they have now.” I prefer a moderate income tax with generous allowances and incentive compatible welfare payments.

We can think of the state as an “insurer of last resort”, with its access to taxation permitting favourable terms for mitigating risk (p. 274). By being able to compel people it also avoids the “adverse selection” problem that befells individuals in particular need. This helps to explain the main economic justification for a well functioning welfare state (p. 276):

- Incomplete private insurance

- Incomplete capital markets

Note though that improving the market in those two areas would reduce the need for widespread social protection.

Luxury

I was very disappointed when Rimowa were sold to LVMH and switched from being a high quality travel company to part of a luxury brand. As Michael Story said,

As per Mary Douglas I view high status consumption goods as part of our need to separate ourselves from others, and signal which groups we belong to. I don’t play those games (at least not on those margina) and think it’s a bit of a waste of resources to do so. But I respect people who admire beauty, design, and the pursuit of aesthetics. Live and let live, I say. But tax the hell out of them…

Labour markets

In terms of workplace diversity and employment discrimination, one of the most famous academic economists is Roland Fryer.

Recommended audio:

- “Roland Fryer on Race, Diversity, and Affirmative Action” EconTalk, September 4th 2023 – Fryer explains how the study of discrimination can be approached in three main ways: preference based (e.g. Gary Becker); information based (e.g. Kenneth Arrow); and structural (i.e. sociologists). He summarises his career, talks fondly about the influence of his grandmother, and the importance of combining intuitive wisdom with rigorous data analysis. His main point is that wage discrepancies are not necessarily discrimination, and companies often lack the curiosity or capability to use the data at their disposal to really understand the problems they face. This helps to explain why the benefit of diversity training is zero, and the impact of mandatory diversity training is possible negative.

Slavery

For an overview of the debate surrounding the role of slavery in the rise of the West see:

- Kedrosky, D., “Capitalism, Slavery, and the Industrial Revolution”, August 26th 2022

- Mokyr, J., “How the world became rich: The historical origins of economic growth” (a book review), EH.net

Recommended audio:

- “Claudia Goldin on Inequality“, Conversations with Tyler, Oct 6th 2021 – this conversation focuses on gender inequality and the labour market in particular, and although some of the discussion is aimed at graduate students they pose some excellent questions to reflect on.

- “Thomas Piketty on the politics of equality“, Conversations with Tyler, April 20th 2022 – Tyler challenges Piketty on some of the political economy arguments relating to progressivism and does a good job putting Piketty’s work into a history of economic thought perspective.

- Ep. 28: Vincent Geloso — Should We Care About Inequality?, The Curious Mind, February 12th 2020 – Vincent talks about which types of inequality are most important to reduce and discusses some of the academic literature that has contributed to our understanding of the issue. His main claim is the need to build a dashboard and avoid overly simplistic explanations or solutions.

Recommended film:

You can see the trailer to Parasite here:

I also recommend the 2021 BBC series Chloe. As this Guardian review demonstrates, when it says “I hope she gets away with everything”, some viewers can actively root for despicable behaviour if it’s presented as a commentary on inequality.

During the class I say that it is inconceivable to have an American movie that portrays wealthy people in a positive light. Potential counter examples include:

- The Dark Knight Rises (2012) – the good guy is a billionaire, the police are heroes, and Bane occupies Wall st… I’m not sure the Batman is a positive depiction of wealth, but it’s certainly a very rare example of a movie that is more right wing than left wing.

- One Day (2023) – Dexter is obnoxious and his wealth and priviledge is not portrayed in a positive light, but we certainly sympathise with him and, as this Guardian review points out, his “wide-boy charisma and frightful yet endlessly forgivable privilege are perfectly pitched; I forgive him a thousand times. His poshness is neither glossed over nor glamorised; it is simply integral.”. Dexter’s dad is a good man, who we sympathise with, and we don’t hold his wealth against him. That’s something, I guess. (Note this isn’t American, or a movie, but I’m open to anything!)

- Saltburn (2023) – this film is a challenging watch but very good (the line “she’d do anything for attention” is perhaps one of the funniest I’ve ever heard). If you’ve read Engleby then I think you lose a large part of its power and originality, and if you understand the Solow growth model you may be confused by the ending. In terms of its implication for inequality, you do sympathise with the rich, and it sort of parallels Parasite’s warning about trust and naivety. But Oliver isn’t poor (despite his bad accent, Prescott is fine!), and the Catton’s aren’t portrayed as having earned their wealth. They are not horrible people but we do laugh at their buffoonery and aren’t asked to respect them. Felix isn’t atrocious but he’s manipulative. Like Parasite, it shows the rich as victims of those less fortunate, and unlike Chloe we’re not supposed to cheer them on. But it doesn’t portray wealthy people in a positive light.

Finally, if you like the plot device from Parasite, with people appearing from underground captivity, confronting a confusing situation as a result of odd costumes, leading to violence and mayhem… then I recommend Emir Kusturica’s Underground (1995):

| Learning Objectives: Survey the latest empirical work on inequality and relate this to wider social issues.

Cutting edge theory: Assessment of a wealth tax Focus on diversity: Thomas Sowell has written extensively on topics such as race and inequality. In this interview he discusses the myths of economic inequality. |