Monetary policy

| Case: “The Euro in Crisis: Decision Time at the European Central Bank” Harvard Business School case no. 9-711-049

Case preparation: The ECB During the Crisis, July 2021 |

| Lecture handout: Monetary policy* |

Textbook Reading: Chapter 7 (Section 7.5 and 7.6; pp. 227-236) and Chapter 8 (Intro, Section 8.1 and 8.2; pp. 237-278)

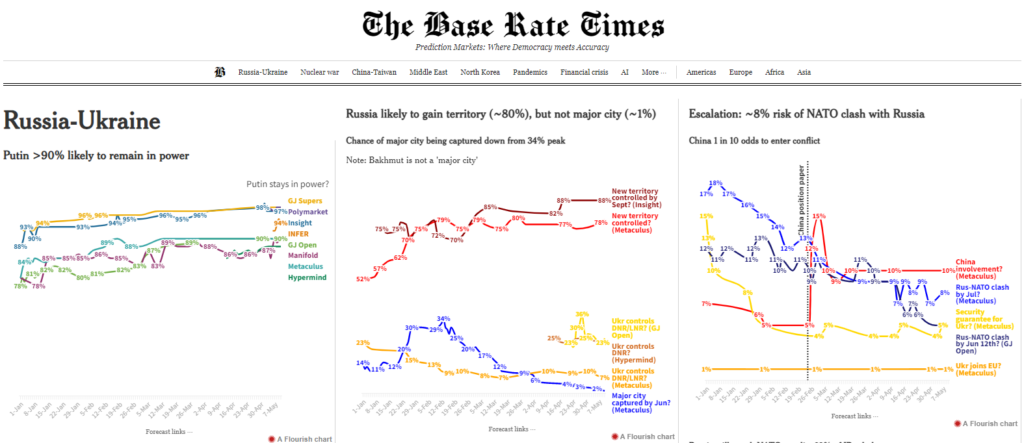

Prerequisites: See my video on Economic Prediction and take this follow up quiz.

The key finding of monetary economics is that the root cause of inflation is excessive money creation. We looked at some specific examples of hyperinflation, and to learn more you can watch “Zimbabwe and Hyperinflation: Who Wants to Be a Trillionaire?” (Marginal Revolution University). The ONS let you calculate your own personal inflation rate here.

Conventional monetary policy is a simple link between a target (usually inflation) and a tool (interest rates). During the lecture I implied that central bankers change interest rates relative to the current rate. In some cases, however, they may be trying to move the policy rate closer to some sort of benchmark. A common benchmark can be calculated using a Taylor Rule. For examples, see Kaleidic Economics.

A corridor system is when the central bank targets three policy rates. We looked at how those rates changed from 2003-2015 in the Eurozone. The ECB website has more recent data.

Recent changes to central bank targets include:

- In August 2020 the Fed announced that it would replace a flexible 2% inflation target with a flexible average 2% inflation target (see here).

- In July 2021 the ECB announced that it would replace a target of “below but close to 2%” with a symmetric 2% target over the medium term (see here).

Extra activity: The Bank of England Museum

Additional activity: NGDP Masterclass

The lecture also introduces the concept of the signal extraction problem. This isn’t the most intuitive concept to grasp, but it explains how nominal shocks can have real effects. In other words how changes in the money supply can affect inflation and real growth. A good article on this is Steve Horwitz’s ‘The Parable of the Broken Traffic Lights“. Here is an article from 2023 in The Guardian, claiming that excess profits drive inflation. The signal extraction problem implies this causality is backward, and Justin Wolfers explains the failure here:

My take on the role of greed in feeding inflation. pic.twitter.com/eQ3jnLJ3jh

— Justin Wolfers (@JustinWolfers) December 13, 2023

| Group activity: Thermostat Worksheet, February 2020 // or complete this form |

| Group activity: Monetary Implications Worksheet, June 2020 |

You can read more details about the Bank of England’s MPC here. I used to regularly participate in the Shadow MPC. A useful resource may be the Kaleidic Dashboard.

| Group activity: MPC Simulation, December 2012 |

| Group activity: ECB Simulation, March 2011 |

Recommended audio

- The EconTalk podcast, and the episodes with Milton Friedman on Money (August 28th 2006), Allan Meltzer on Inflation (Feb 23rd 2009), and Charles Calomiris on the Financial Crisis (Oct 26, 2009), are particularly relevant for this session.

- The Planet Money episode called “Two indicators: The 2% inflation target” (January 13th 2023) provides a history of, reasons for, and explanation of deviations from the 2% target.

- I also recommend the episode of Macro Musings called Scott Sumner on The Money Illusion (October 2021)

- This episode from Conversations with Tyler, Mark Carney on Central Banking (May 2021) does a nice job of setting the objectives of a central banker, in a modern economy, related to issues such as climate change and digital currencies. It provides an engaging awareness of some of the differences between major central banks.

- The Macro Musings episode with Jens van ‘t Klooster on Recent ECB Policy (May 2022) discusses the recent change in the ECB’s remit, how ECB actions differ from the Federal Reserve, and does a really nice job of whether the 1990s model of central banks is outdated and needs to evolve due to changing circumstances and priorities (such as climate change and elevated sovereign debt).

Recommended video

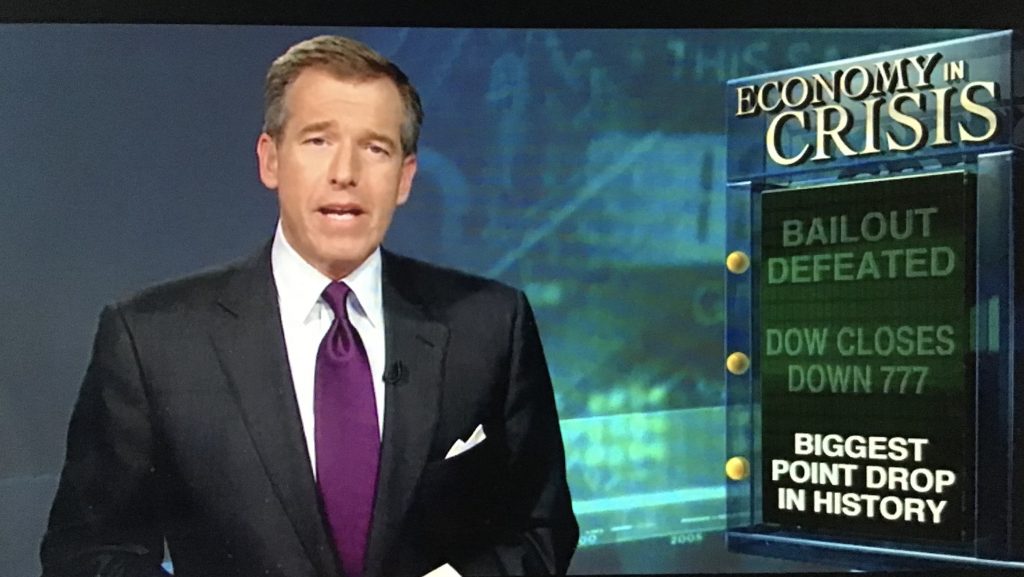

For my account of the 2007-2008 financial crisis:

| Learning Objectives: Understand the root causes of inflation, and contribute to policy discussions. Understand how monetary policy affects business decision-making and thus generates macroeconomic fluctuations. See the operation of a conventional monetary policy regime in practice. Contrast the ways in which the Fed and the ECB acted during the global financial crisis.

Cutting edge theory: Nominal income targeting and surveying current monetary indicators. Focus on diversity: One of the most influential books on monetary economics was co-authored by Anna Schwartz. You can learn more about her here. In 2019 Christine Lagarde became the first female president of the ECB. Prior to that she was the managing director of the IMF. You can read her article on how women can grow the global economy here. Spotlight on sustainability: We look at how interest rates enable intertemporal coordination |

In some places, such as Lodz, aesthetic streets are about returning to past beauty. This just shows that the destruction of growth is a terrible thing, and we should appreciate its manifestation where we have it.

In some places, such as Lodz, aesthetic streets are about returning to past beauty. This just shows that the destruction of growth is a terrible thing, and we should appreciate its manifestation where we have it.