Fiscal Policy

| Case: Yared, P., “The Obama Stimulus“, Columbia CaseWorks, January 3rd 2014

Case preparation: The Obama Stimulus, November 2021 |

Note: I usually skip this case and provide a case study instead.

| Lecture handout: Fiscal policy* |

Textbook Reading: Chapter 7 (Section 7.1; pp. 200-211) and Chapter 9 (Intro, Section 9.1, 9.2, 9.3, 9.4 and 9.5; pp. 287-325)

| Group activity: US Multiplier, February 2026 (used with “Fiscal Multiplier Worksheet“, March 2018) |

“Uncertainty has a bad impact on the state of the economy” Boris Yeltsin, 1991 (see Zubok, 2021, p.369)

For some documentaries on the Obama stimulus, see:

- Video: Part 1: The First 100 Days of “Inside Obama’s White House” BBC2 (iPlayer)

- Video: Hank Paulson: What I Could Have Done Differently (US Netflix)

A practical example of the empirical claims of the signal extraction problem are mentioned in this letter sent to Sequoia founders and CEOs: “In downturns, revenue and cash levels always fall faster than expenses”.

Keynesian approaches to aggregate demand management became popular because they were seen to have explained the problem of the Great Depression. My video on the Great Depression explores some of the history, and see here for more resources on the global financial crisis.

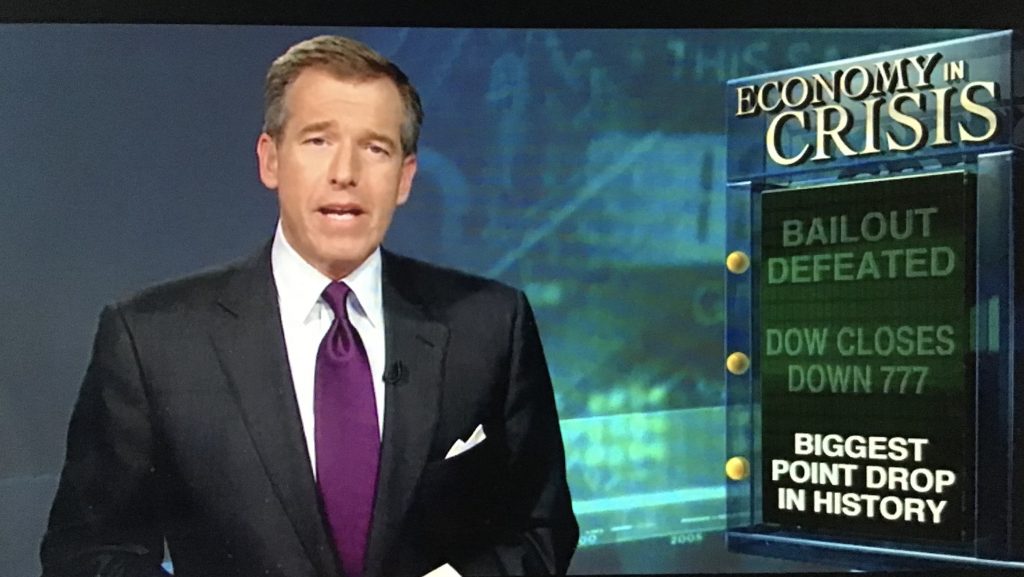

Narrated by Matt Damon, the 2010 Documentary ‘Inside Job’ (see here for a trailer) stated that “In September 2008 the bankruptcy of the US investment bank Lehman Brothers and the collapse of the world’s largest insurance company, AIG, triggered a global financial crisis.” But the graphic used to accompany the subsequent stock market crash has “bailout defeated” as first main bullet point! As my lecture argues, it may well be the policy uncertainty that accompanied the attempt to intervene in the markets that prompted the disarray and confusion, and not the bankruptcies themselves.

I know that I wouldn’t make a good Jason Bourne, so maybe Matt Damon should leave teaching economics to me…

The content on policymakers feeling pressurized to “do something” is an element of crisis management more generally. Mirowski (2013) argued that during the global financial crisis “being seen to act… had preempted the equally necessary stage of reflection and reform” (p.5) and I would argue that this is a common feature of crisis management beyond just discretionary fiscal policy. An interesting example of the types of trade off that policymakers face is BBC Radio 4’s ‘Discussion Time: Coronavirus‘. Even though it relates to an epidemiology situation, it is relevant for any PR situation. Policymakers face a balance between maintaining public confidence, being seen to be providing a quick and clear response, without inciting a general panic. This relies on having good frameworks and tools that relate to the specific situation (the Radio 4 panel explain how important expert forecasts of the spread of foot and mouth disease were, in a recession economic impact studies play a critical role); but also an ability to manage public expectations. The goal of successful crisis management is to balance these things without introducing new uncertainties.

Despite what I say in the lecture… not all dog rescues are disasters…. (see here and here).

Recommended audio

- “Donald Kohn on Fed policy from the 1970s to today” Macro Musings (from 33:00 – 43:08)

- “Robert Hall on Recession, Stagnation, and Monetary Policy” Econ Talk (from 0:00-7:19)

- Explain what Hall means by “automatic stabilisers”

- What does Hall claim is the main reason for the discretionary fiscal policy of 2009 to have had a weak impact? States spent the money

- Does Hall believe that the US economy had a fiscal stimulus in 2009? No – he claims that since the government as a whole didn’t increase spending it wasn’t a stimulus.

- “Robert Hall on Recession, Stagnation, and Monetary Policy” Econ Talk (from 49:51-56:23)

- What’s the conventional definition of a recession?

- How does the NBER officially define recessions?

| Learning Objectives: Assess the efficacy of fiscal stimulus and aggregate demand management. Perform back of the envelope calculations to estimate the fiscal multiplier for a range of different countries.

Focus on diversity: Christina Romer was the Chair of Obama’s Council of Economic Advisors during the stimulus. You can learn more about her here. |