Prediction Markets

| Case: Coles, Peter, Lakhani, Karim and McAfee, Andrew, “Prediction Markets at Google” Harvard Business School Case No. 9-607-088, August 20, 2007

Case preparation: “Prediction Markets”, February 2016 |

Textbook Reading: Chapter 4 (Section 4.5; pp. 127-134)

I am Facebook friends with someone who used to work at Google – here’s a photo of one of the T-shirts:

The Google case was published in 2007 and was accompanied by a lot of interest in prediction markets. In 2021 they launched a new internal prediction market because of two main reasons:

- Even more Google employees (i.e. a bigger crowd)

- Better technology in the form of Google cloud

I am an academic not an entrepreneur, but if there’s one area that I think is ripe for a successful venture it’s creating the go to prediction market. By the early 2000s we had established that prediction markets were an effective tool for corporate management, and we also learnt how useful they could be for a broad range of policy issues. It’s a scandal that governments – and the US in particular – have been so opposed to their use. (The reason is that they’re treated either as gambling firms or futures traders which are two of the most targeted and heavily regulated and industries). According to Scott Alexander:

There ought to be a billion dollar prediction market, maybe a ten billion dollar one. Smart VCs clearly believe something like this, or Kalshi wouldn’t have gotten $30 million+ in investment. Sometimes people who incorrectly believe I know things about prediction markets ask me if know the missing secret sauce. I don’t think there’s any secret. A prediction market will strike it big when it gets three things right at the same time:

-

- Real money

- Easy to use

- Easy to create your own subsidized markets

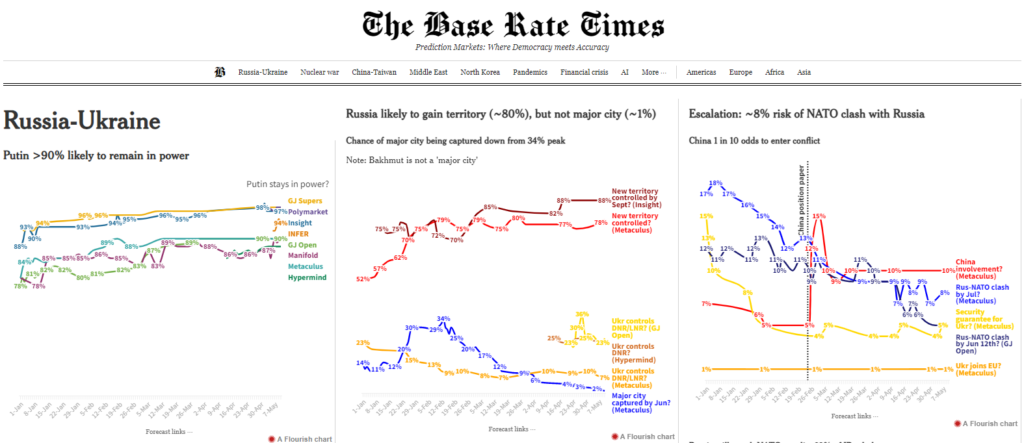

It’s a dream of mine that I may have students who manage to put those things together, solve the regulatory issues, and launch a killer app. So far the closest is probably Polymarket but also see Prediki. Here is a website that aggregates prediction market data:

That said, Michael Story is a superforecaster and has made some important criticisms of prediction markets. See here. Perhaps the best attempt to explain the failure of predictions markets to gain traction is here:

- “Why prediction markets aren’t popular” by Nick Whitaker & J. Zachary Mazlish, Works in Progress, May 17th 2024

They define prediction markets as “contracts that trade on the outcome of future events” and split traders into three types:

- Savers: people who want to increase their wealth

- Gamblers: people who want excitement

- Sharps: people who attempt to profit from better quality analysis

They argue that “most things we might want to know about the future aren’t much fun to bet on”, and this results in a lack of demand: “without savers or gamblers to add volume to the market, the market cannot attract enough sharps to create the liquidity to drive prices toward accuracy.” I am not so pessimistic about the potential for prediction markets, but recognise that in order to work they must:

- Have short time horizons

- Be as fun as possible

- Be subsidised

Here are a couple of op-eds on the benefits of insider trading:

- “Don’t regulate banking – liberalise it“, by Anthony J. Evans, Guardian Unlimited, September 14th 2009

- “Learning to Love Insider Trading” by Donald Boudreaux, Wall Street Journal, October 24th 2009

- “Insider trading enriches and informs us, and could prevent scandals. Legalize it“, by Dylan Matthews, July 26th 2013

Here is a New York Post article explaining how Nancy Pelosi (and her husband) have benefitted from trading off the stocks of companies that she regulates, and why she is resisting efforts to stop Congressional lawmakers from being able to continue to do so. You can track her trades here. Here is a funny halloween costume.

To read more about the “Policy Analysis Market” (PAM) which was designed by Robin Hanson as a tool for the US Department of Defense, but got cancelled in July 29th 2003 having been described as a “terrorism futures market” by the Washington Post, see:

- “Pentagon kills ‘terror futures market’” by John W. Schoen, NBC News, July 29th 2003

- Hanson, R., The Policy Analysis Market A Thwarted Experiment in the Use of Prediction Markets for Public Policy

The Climate Risk and Uncertainty Collective Intelligence Aggregation Laboratory (CRUCIAL) uses prediction markets to learn more about future climate related challenges. See:

- Roulston, M., Kaplan, T., Day, B. et al. Prediction-market innovations can improve climate-risk forecasts. Nat. Clim. Chang. 12, 879–880 (2022)

Or this video:

Finally, for more about the management failure that led to the Challenger disaster, see:

- “Remembering Roger Boisjoly: He Tried To Stop Shuttle Challenger Launch“, Howard Berkes, npr, February 6th 2012

Recommended reading

- Prediction Markets in Theory and Practice, Justin Wolfers and Eric Zitzewitz, NBER Working Papers, March 2006

- “Using Prediction Markets to Track Information Flows: Evidence from Google” Bo Cowgill, Justin Wolfers and Eric Zitzewitz, January 2008

- The Promise of Prediction Markets, Policy Forum, May 2008

- Also see Kaleidic Economics: http://www.kaleidic.org/prediction-markets

Recommended video

Recommended audio

“Why There Aren’t So Many Hotel Fires Anymore” Stuff You Should Know.

Points to consider:

-

- Key technology = fire doors, sprinklers, and alarms that anyone can set off. Imagine how many major hotel fires would occur if staff had to wait to inform senior management before receiving authorisation to call the fire brigade.

| Learning Objectives: Understand how to operate a prediction market. |