Justice

This course considers different ways of understanding the concept of justice, and how managers can apply these insights within an organisational setting.

This course considers different ways of understanding the concept of justice, and how managers can apply these insights within an organisational setting.

Lecture handouts

Textbook

- Schmidtz, D., 2006, Elements of Justice, Cambridge University Press [Buy from Amazon.com]

Other courses

- Michael Sandel’s legendary Harvard course on Justice is available as an online course (view Part 1 here).

Further resources

A charming example of passing on a favour is the music video to Clay Walker’s ‘Chain of Love‘:

Here’s Hans Rosling explaining why most of the world is better off than you think:

You can watch the PBS version of ‘Command and Control’ here.

There is a short series of videos where David Schmidtz discusses Equality. You can view them here:

There are three excellent TV series that feature strong, mature female leads. They are:

- Happy Valley, 2014

- Mare of Easttown, 2021

- After the Party, 2023

The latter in particular is all about the principle of justice, as we see Penny cope with the aftermath of having made a serious allegation against her husband. As this Guardian review says,

“The levels of denial people can sustain, along with the fight between moral courage and cowardice, and how hated the former can make you, are two of the major themes of this dark, provocative drama.”

Quiz

Business Economics (BIM)

This course will develop student’s capacity for economic analysis and awareness of the insights for management. The focus of the course is on the principles of microeconomics relevant for managerial decision making and the limits of markets, including asymmetric information; monopolies; and ethical frontiers.

📚 Textbook

Evans, Anthony J., 2020 “Economics: A complete guide for business“, London Publishing Partnership

[S] Schotter, A., “Microeconomics: A Modern Approach” South Western (2008, International edition, approx. £60)

🗓️ Content

| Topic | Lecture content | Textbook reading | |

| 1. Consumer theory | 1a. Incentives Matter* (+)

Evans, A.J., Incentive design, December 2020 1b. Max U (+) Evans, A.J., “Maximilian Untergrundbahn”, January 2018 Instructions: Complete the assignment questions |

[E] Ch. 1

[S] Ch. 2, 3, 4 |

|

| 2. Understanding demand | 2a. Value creation* (+)

2b. Value creation activity |

||

| 3. Practical supply decisions | 3a. Understanding cost* (+)

3b. Cost curves* (+) Evans, A.J., “La Marmotte”, January 2012 Instructions: Complete Exhibit 1 and provide suggestions for the two key decisions |

[E] Ch. 2

[S] Ch. 8, 9, 10, 14 |

|

| 4. Real world markets | 4a. Auctions (+)

Hild, M., Dwidevy, A., and Raj, A., 2004, “The Biggest Auction Ever: 3G Licensing in Western Europe”, Darden Business Publishing Discussion question: What are the alternatives to auctions? 4b. Market Applications (+) |

[E] Ch. 3

[S] Ch. 15, 21, 22 |

|

| 5. Limits to markets | 5a. Markets in everything (+)

“I’ve got debts, please buy my kidneys” The Times September 27th 2009 Discussion question: What are some different ways in which we could allocate kidneys? 5b. Shortage DB |

||

| 6. Asymmetric information | 6a. Adverse selection (+) Akerlof, G.A., (1970). “The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism”. Quarterly Journal of Economics 84(3):488–500 (£)6b. Signalling* (+) Spence, M., (1973). “Job Market Signaling”. Quarterly Journal of Economics 87(3):355–374 (£) |

[S] Ch. 23 | |

| 7. Pricing strategy | 7a. Price discrimination

Read the following Twitter thread Instructions: Verify as much of the information in the case as possible 7b. Price discrimination DB* (+) |

[E] Ch. 4 | |

| 8. Competition policy and regulation | 8a. Competition and the market process* (+)

8b. Capital theory* (+) |

[E] Ch. 5, Ch. 6

[S] Ch. 19 |

|

🏅 Assessment

- 0% Problem set (download here)

- 40% Group report (see here for instructions)

- 60% Final exam

Research impact

I recently learned of the death of two people who, in very different ways, played important roles in my early academic career. In reflecting on their passing, I have gained clarity over my frustrations with contemporary research. I shall explain.

Walter E. Grinder was a key part of the organisational and intellectual rehabilitation of classical liberalism that occurred in the 1970s. He was a true ideational entrepreneur and although he made significant scholarly contributions of his own, his biggest impact came from linking people to ideas and to each other.

Walter E. Grinder (1938-2022)

For example, the Mercatus Center at George Mason University is the definitive model of a public policy arm of a reputable academic establishment. It emerged out of the Centre for Study of Market Processes, which originated at Rutgers University and Walter was there for that. When the Institute for Humane Studies moved to George Mason in 1985, Walter (as vice-President) was the impetus. Walter had studied under Hans Sennholz which gave him direct lineage to my favourite economist of all time (Ludwig von Mises) and he even attended Mises’s seminar at NYU. This gave him access to an intellectual tradition that was severely waning, and he helped nurture and steer the careers of people like Tyler Cowen, Peter Boettke and Larry White. As Alberto Mingardi has said, “Never underestimate the role of the person who puts a good book in your hands”.

As a graduate student, I was well aware of the key personnel behind the second “Austrian revival” and was proud to join Walter’s infamous email list in 2006. I also knew that he was based in Mountain View so when I visited San Jose as a Fulbright Scholar in 2011 I reached out to him. We went for coffee and had a long and wonderful conversation. I knew that he had health problems, and did not expect to be able to meet him again. I thanked him for the role he had played in creating the intellectual and professional landscape that I had entered. It was a meaningful experience, and on behalf of my generation of economists, I am glad I was able to say that in person.

For more about Walter see this collection of resources, published by Cato on the occasion of his 75th birthday.

It was with much greater shock that I also recently heard that Jeffrey Friedman had passed away (see this obituary by Ilya Somin). Jeff had a thing: the epistemological foundations of political economy. He thought about it more than anyone else, and founded and steered a wonderful journal, Critical Review, with that as its core focus. In 2008 I wrote to Jeff because I’d heard that he was publishing a special issue about Bryan Caplan’s ‘The Myth of the Rational Voter‘, and I had a paper outlining a subjectivist critique. I got an enthusiastic and incredible detailed and helpful reply which prompted a correspondence that led to him soliciting my work, offering his guidance, and ultimately becoming a co-author. I believe that relationship was common, and Jeff’s infectious obsession has simultaneously frustrated and prompted many early stage careers! Our article was eventually published in 2011, called, ”Search” vs “browse”: A theory of error grounded in radical (not rational) ignorance” and the parts of my original article that he didn’t like became “A subjectivist’s solution to the limits of public choice” (published in 2014 by the Review of Austrian Economics).

Jeffrey Friedman (1959-2022)

Each of these two men revealed an appealing vision of academic life, and could easily be treated as role models. A modern Walter would manage an email list (or substack) alerting select people to new works and commentary – a mentor and connector. Someone who also contributes to funding decisions and arranges conferences and professional workshops. And Jeff’s example of a scholar who creates and nurtures a journal that carries an editorial focus in every issue, with spin off books and a distinct and unique voice, remains underappreciated and much needed. Yet both of these models would constitute career suicide for young academics, and be indulgent and in tension with the professional incentives or demands for mid career ones.

~

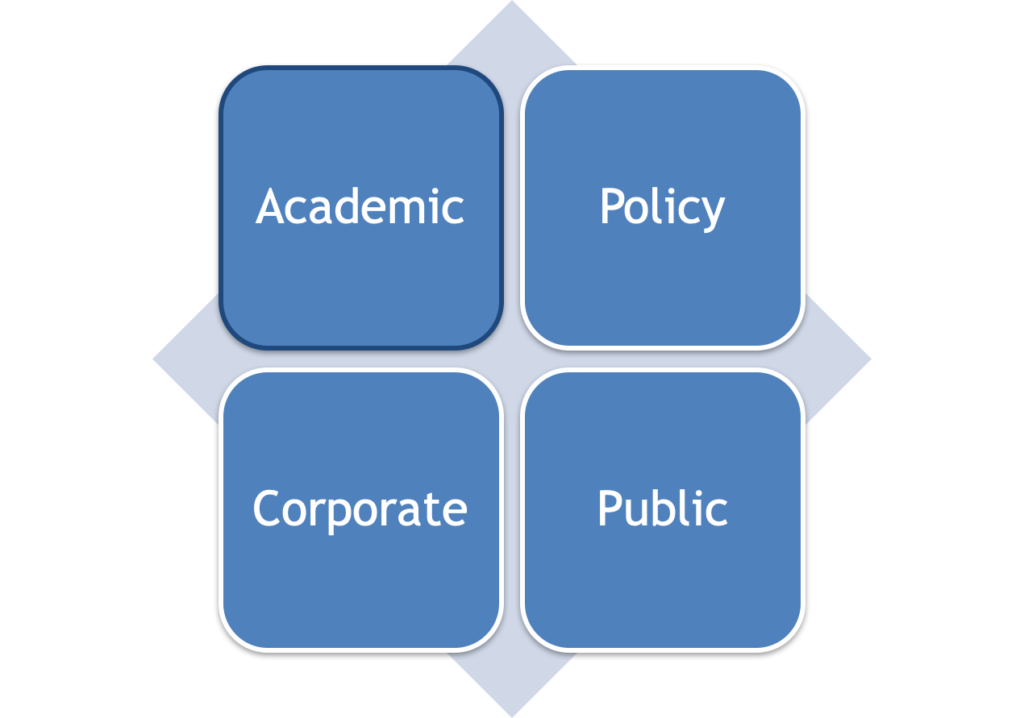

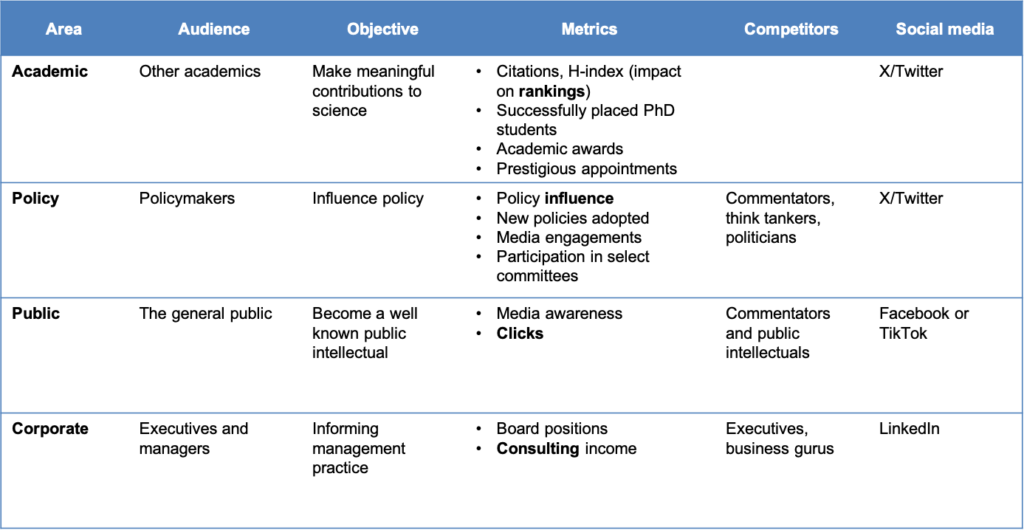

Over recent years I’ve made a deliberate decision to clean up my research “pipeline” and dispense with long standing research topics in order to create scope to assess my direction and sharpen my focus. And I’ve been reflecting on what our objectives, as academic researchers, should be. To me, there are four areas where we can establish our impact but each of these areas imply separate audiences, and therefore have different objectives.

- The first and most obvious dimension is academic – and should of course be the foundation. To some extent other dimensions flow from this (hence the different border colour) but I don’t want to propagate the myth that research impact must escape the ivory tower in one leap. In this dimension, your audience is other academics and the objective is to make meaningful contributions to science. Elite academics will have heavily cited books and articles, well placed PhD students who continue that intellectual work, and recognition from their peers in terms of awards and prestigious appointments. Other academics will publish, but struggle to justify whether that, in itself, has any wider impact on society.

- We can also have policy impact – and see how our research improves the functioning of society. In this case, the audience is policymakers and the objective is to influence policy.

- Many of us seek public impact – and reaching the hearts and minds of “the man on the street” can be a noble aim. Here, the audience is the general public and the objective is to become a well known public intellectual.

- Practical research can also have a corporate impact – particularly those of us who work in a business school might want to see our research improve the performance of organisations. The audience is executives and actual managers and the objective is to inform management practice.

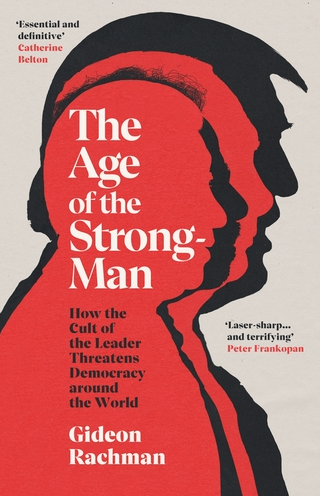

An important factor in all this is legitimacy. Academics face competition from an array of different professions within each area. For academic status we compete with journalists and commentators. Our academic books are increasingly aimed at explaining research findings for a non-academic audience, and a lot of published articles are merely under researched think pieces. (Notice the similarity, in content and style, between two recent books on informational authoritarianism. One by Gideon Rachman, an FT journalist. And the other by Sergei Guriev and Daniel Treisman, tenured and elite academics.)

For policy status we compete with commentators, think tankers and politicians (who, like journalists, tend to be young, hungry, and in plentiful supply).

For public status we compete with commentators and public intellectuals.

And for corporate status we compete with executives and business gurus.

It is hard for academics to make a mark in these competitive arenas, especially when scholarly integrity can weigh us down and it is merely our academic title that delivers status. It’s no surprise that the industry is full of charlatans of all stripes – people who are too lazy and ill disciplined to be journalists (!), too idiosyncratic and out of touch with public opinion to be politicians, and without the management skills to do well in business. It really is remarkable how academics get encouraged to enter each of these territories, as if there is merit in doing so.

To maintain legitimacy, however, academics must have some scholarly achievements to fall back on. I’ve written elsewhere about whether media engagements should have a basis in scholarly expertise, but the bottom line is that without peer-reviewed publications we are merely hacks (bad journalists), charlatans (anonymous pundits), or grifters (failed business people).

At various points in my career, I’ve been all four. On each dimension I’ve felt some success, and glimpsed what it might take to achieve genuine impact.

- Academic impact – I’ve had over 40 peer-reviewed journal publications including two from the FT 50 list. And yet those two publications were two of the worst academic articles I’ve written, and reflected an opportunistic and somewhat degrading effort to reach that list rather than achieve any scholarly accomplishment. My article with Jeff Friedman was one of my best, most cited, and appeared in a journal on the Social Science Citation Index, yet it has zero weight on internal metrics of research performance (because the journal doesn’t contribute to standard business school rankings lists). I’ve been discouraged from submitting to field journals even though they tend to be more widely read, and contribute more to my professional reputation, than higher listed ones. As a graduate student you crave that first journal publication and each hit is something to celebrate. I’m proud that I’ve had at least one publication in every year since I obtained my PhD. And yet I don’t feel much professional advancement as a consequence. This may be a reflection of research strategy, and my preference for single authored papers on a wide range of topics. But to some extent I feel that I’ve played the “publish or perish game”, done ok, but think “and what about it?” I don’t have PhD students and therefore don’t feel I’m in a position to establish whether I have the capabilities to achieve an elite research career or not. But publish for the sake of publishing? Sacrificing your life to become an unpaid content creator for Elsevier? Really?

- Policy impact – I’ve had policy proposals that have received widespread media coverage (including front pages of broadsheet newspapers and even page 3 of The Sun) and have made legitimate contributions to actual policy reforms (such as the rate of corporation tax). And yet the UK policy environment is cut throat and fast moving. I knew that my voice was more powerful due to my academic credentials than my scholarly expertise, and that many examples of media coverage compromised my integrity. I don’t have the stamina or inclination to become a go to figure for broadcast media, and am saddened by the fact that on the occasion where we had a PM that was keen to promote the very ideas I’m passionate about the whole thing was an epic clusterfuck. Ok, we can meme the PM to ban certain dog breeds. But should we?

- Public impact – I’ve had a weekly column in a large circulation newspaper that ran for over a year and have written a practical and accessible guide to economics. I ran a social media workshop for faculty to engage in public conversations and we all boosted our Klout score. I have more LinkedIn followers than many full time LinkedIn influencers. And yet I have seen no real tangible consequence to that. I don’t make much money from book sales and speaking engagements dried up some time ago. I find social media fairly boring and am back to reading The Economist, like a disaffected undergraduate.

- Corporate impact – I was one of the first and only academics to be invited to an internal training program for a company that utilises concepts and frameworks that are at the heart of my academic interests. And yet I’ve not been able to leverage that either within a standard business school curriculum or by providing in house training. I have a good understanding of what topics are in demand and routinely deliver training programmes for executives. But I have no market power (more pay requires more hours on the ground) and not a single former student has seen any benefit in my involvement in their company decision-making. Should I degrade myself by contributing to my own “company”, and giving students the perceived legitimacy of an instructor that runs a barely operational side hustle? I don’t think so.

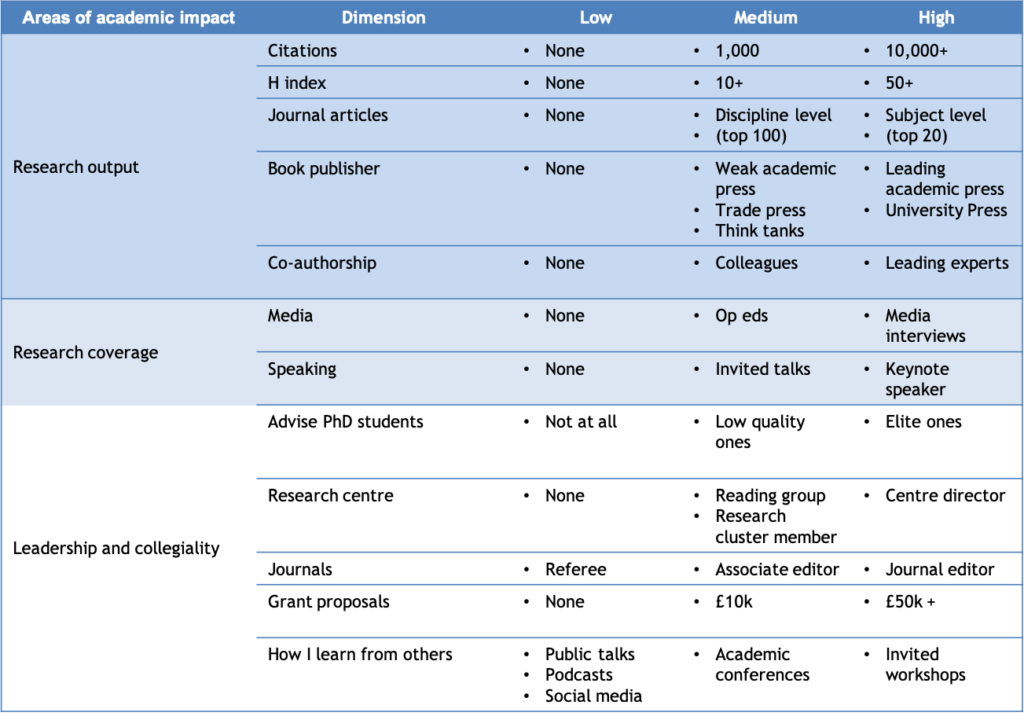

For purely academic impact, we can look at several key areas: research output, research coverage, and leadership and collegiality. As the table below shows, we can consider various success levels. As we move through our careers we should progress towards the right on many of these dimensions. This is, I think, standard, familiar, and achievable. But it does not constitute the type of wider impact many of us attempt to talk about.

~

So what to do?

If you ask a decent academic what motivates your research they’ll say ideas. But no-one will pay you to do that. Impact matters, and each dimension has a metric. Ultimately, you have to chase one of the following:

- Citations – academic prowess.

- Influence – demonstrable impact on policy reform.

- Clicks – social media metrics.

- Consulting gigs – being hired.

So pick your master.

Market applications

| Group activity: Market Applications Assignment, December 2022 and complete this Market Applications Form |

| Instructor resource: Market Applications Solutions, December 2022 |

This topic is all about how market exchange generates prices, which can be used for information purposes. Here is a good quote explaining the marvel of the price mechanism:

“A spike in wages of carpenters, in a uniquely reliable way, tells consumers that the community needs them to be more economical in their use of carpentry services while also alerting potential suppliers to a rising need for carpenters. Falling prices, again in a uniquely reliable way, signal suppliers that a community already has all it needs. From such coordination, mediated by freely adjusting price signals, a nation’s wealth is made” (Schmidtz, 2023, p. 102)

In 2025 the city of New York introduced a congestion charge in the whole of lower Manhattan to try to reduce traffic.

As The Economist reports, early results revealed that rush hour journey times had been cut in half.

As The Economist reports, early results revealed that rush hour journey times had been cut in half.

Recommended listening:

- Special Episode 12: Jen Dirmeyer – What Do Markets Do For Us? The Curious Task, July 27th 2022 – Jen Dirmeyer talks about the marvel of market order, with a particular focus on the incredible coordination that takes place to deliver consumer goods in contemporary society. She points out that supply curves reflect the best alternative use of resources and demand curves reflect the best alternative way of satisfying consumer needs, and in doing so rest on the same underlying logic. Also, I really liked Jen’s emphasis on an important downside of the reliance on market exchange – people with higher incomes, or higher budgets, are at a significant advantage over those less fortunate. This is indeed a social problem but the choice between economic systems is a choice between one that emphasises economic power versys one that emphasises political power. And the former may well be more egalitarian overall. Because economic wealth creation is positive sum, and therefore one person’s advantage need not come at the expense of another’s.

EMBA Managerial Economics – ESA

This course provides an overview of core economic concepts and how they relate to senior executive management. Particular focus will be placed on the theory and practice of internal markets and how organisations have harnessed the knowledge and incentives provided by market mechanisms. Group work will focus on an analysis and assessment of the macro context for a relevant country, looking at monetary and fiscal policy as well as a broader set of social and environmental indicators.

Course textbook:

- Evans, Anthony J., 2020 “Economics: A complete guide for business“, London Publishing Partnership (buy through Amazon.com here)

Course handouts: download here

Schedule: download here

Instructions for the group report: download here

| Pre-class activities |

| All cases need to be read and prepared in advance. Textbook chapters are not mandatory but are highly recommended for students without a strong background in economics. I’ve also provided a few videos and quizzes which should be helpful. |

| Day 1: Micro |

| To verify you have the maths skills necessary for this course, complete this quiz.

1. Incentives matter* (+)

2. Understanding cost* (+)

3. Auctions (+)

4. Market applications (+)

Extra activity: The Dutch flower auction |

| Day 2: Macro: closed economy |

| Before class you should watch this video and pass this quiz.

5. Inflation*

6. Macro Policy*

7. Macro Risk*

8. Macro Policy Workshop (+) After class you should watch this video and pass this quiz. Extra activity: NGDP Masterclass |

| Day 3: Macro: wider issues |

9. International economics (+)

10. Macro Trends* (+) 11. & 12. Group preparation and presentations |

| Revision |

| An optional online version of this course, which may be helpful for revision, is available here. |

Note:

Cases marked with a pound sign (£) are available via the learning platform.

What I’ve been reading:

- Ghattas, K, 2020, Black Wave, Wildfire

What I’ve been listening to:

- The Tragedy of the Middle East: A Letter from Lebanon, The David McWilliams Podcast, October 1st 2024 – recorded in September 2024, I found this this interview with Carole Nakhle to provide a good perspective on the economic history and current political situation.

What I’ve been watching:

Malina Angelica is one of my favourite travel vloggers and so before teaching this course I watched her video on Lebanon and also this episode on Beirut:

NGDP masterclass

This webpage gathers some key resources to help you understand what a NGDP target is, and why I think central banks should be more open to adopting them. I am convinced that delivering macroeconomic stability should be the prime objective of any central bank, and that an NGDP target would be a good way to achieve this. Let’s see why…

What is an NGDP target?

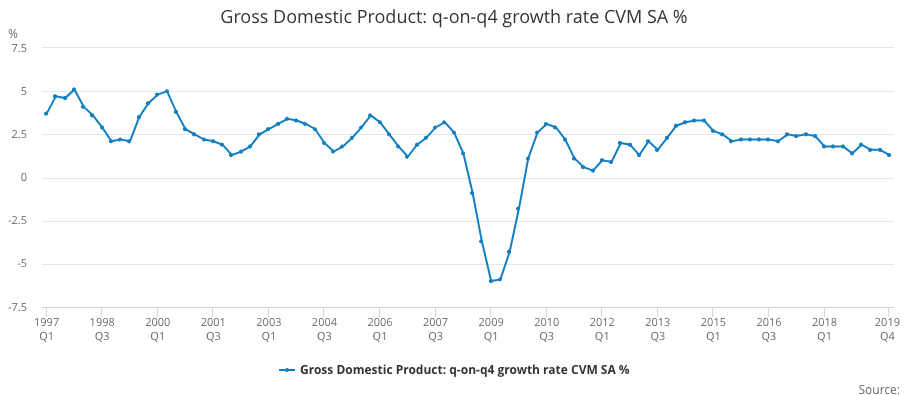

You probably know that GDP stands for Gross Domestic Product. This is the conventional way of measuring economic activity, and reveals the market value of final goods. When we’re interested in whether people are getting richer or poorer, we look at real GDP, which strips out the effects of inflation. This allows us to make meaningful comparisons about the productive performance of an economy across different time periods, and the chart below shows what’s happened to GDP in the UK from 1997-2019:

Source: ONS (Gross Domestic Product: q-on-q4 growth rate CVM SA % (IHYR))

The real growth rate for the UK from 1949-2019 averaged 2.5%, but more recently it seems to be below this. While this may be a concern, in normal times it is driven by factors outside the control of central banks (such as the productivity of labour and capital).

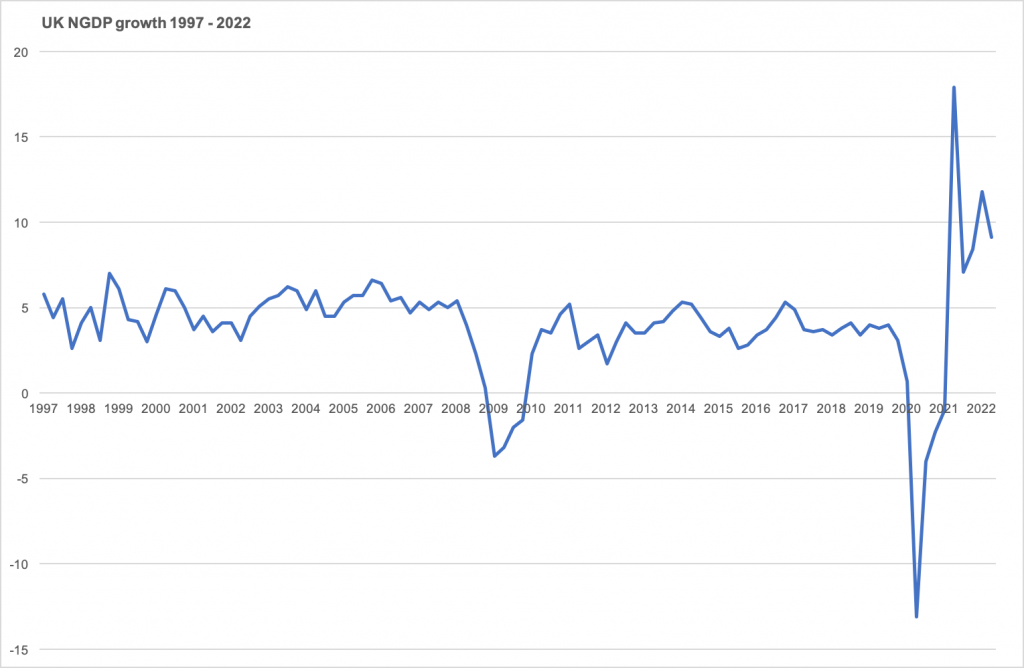

Central banks do, however, have a large influence over the nominal growth rate, which is the cash value of economic activity (i.e. without stripping out the effects of inflation). The chart below shows annual NGDP growth from 1997-2022.

Source: ONS (Gross Domestic Product: q-on-q4 growth quarter growth: CP SA % (IHYO))

Notice a few interesting things:

- Prior to the global financial crisis (i.e. from 1997-2008) it was fairly stable at around 5%.

- It significantly contracted during the global financial crisis.

- From 2011-2019 it was slightly more volatile and a slightly lower rate (averaging below 4%).

- It was extremely volatile during the covid pandemic and recent energy shocks.

Now, here are the big claims I wish to make:

(i) The reason that economic performance was reasonably good from 1997-2008 was because NGDP growth was stable.

(ii) The subsequent and more recent poor performance was due to having left that 5% growth path.

What do central banks do?

Most central banks utilise an inflation target, where their primary objective is to deliver low and stable inflation. And this is how we typically judge whether they are doing their job. For example,

- The Bank of England has an explicit 2% inflation target.

- The European Central Bank is supposed to deliver “price stability”, which they believe is “best maintained by aiming for 2% inflation over the medium term”.

- The Federal Reserve has a “dual mandate”, which is a twin objective of delivering maximum employment and stable prices.

However, many economists question whether this is the best way to conduct monetary policy. Instead of trying to keep consumer prices stable and assume that other important variables will follow from that, an NGDP target aims for a stable environment for all wage and debt contracts, because labour and credit markets are more important for economic planning than a specific set of consumer prices. Indeed, NGDP is less volatile than CPI, and NGDP is more relevant for concerns about debt sustainability.

It is therefore interesting to see that even back in 2012 NGDP targets were receiving attention from important central bankers:

- The former governor of the Bank of England, Mark Carney (see here)

- The former chair of the Federal Reserve, Janet Yellen (this speech has been widely interpreted to incorporate attention to NGDP growth in policy decisions)

Some theory

Consider the following “equation of exchange” (where each variable refers to a growth rate):

M+V=P+Y

The power of this equation is that it rests on a tautology, which is that the total spending across the entire economy must be equal to total receipts. That being the case, we can break down total spending into two components: the amount of money that is available to spend (M), and people’s desire to spend the money already in circulation (V). Spending rises when more money gets created, or if people choose to spend more of what they already have. Central banks therefore stimulate the economy either by Quantitative Easing (more M) or reducing interest rates (more V). This “total spending” is sometimes referred to as aggregate demand, but notice that it is equal to the combined rate of inflation (P) and real GDP growth (Y). It is through their ability to determine the amount of aggregate demand that central banks will directly affect nominal GDP (P+Y). And since one person’s expenditure is another’s income, another term for NGDP is nominal income.

For more on using this equation as a foundation for understanding macroeconomic policy objectives and performance, see here.

Some history

Nominal income targets first became popular in the 1980s, when the prevailing focus was targeting the money supply (as pointed out in this presentation by Jeff Frankel). Some big name economists gave them attention, including in the following famous articles: (for a longer list see here)

- Meade, J. 1978, “The Meaning of “Internal Balance” The Economic Journal, 88(351), 423–435.

- Tobin, J., 1980, “Stabilization Policy Ten Years After” Brookings Paper on Economic Activity, 11, 19-90.

- Bean, C. R. 1983, “Targeting Nominal Income: An Appraisal” The Economic Journal, 93(372), 806–819.

More recently, following the global financial crisis, there has been a second wave of interest in NGDP targets, for example:

- Woodford, 2012, “Methods of Policy Accommodation at the Interest-Rate Lower Bound“

- Frankel, J., 2013 “Nominal-GDP targets, without losing the inflation anchor” in Is Inflation Targeting Dead? Central Banking After the Crisis, VoxEU

- Sumner, S. 2014, “Nominal GDP Targeting: A Simple Rule to Improve Fed Performance.” Cato Journal 34 (2): 315–37

- Beckworth, D., and Hendrickson, J. R., 2016, “Nominal GDP Targeting and the Taylor Rule on an Even Playing Field.” Mercatus Working Paper. Arlington, Va.: Mercatus Center at George Mason University (October).

This second wave has come in the context of perceived failures of inflation targets.

We can therefore witness a steady evolution in thought: perhaps instead of being bound by a money growth rule (M), or an inflation target (P), the central bank should instead target nominal income (P+Y). This means that real productivity will determine the split between inflation and real growth – if productivity is strong then inflation will be low, but when there’s a real business cycle slow down inflation is permitted to rise. These adjustments will take place such that NGDP remains stable. This video by MoneyWeek does a nice job explaining how this balancing act is already part of the Fed’s perview:

The increased influence of NGDP…

Scott Sumner has been described by The Atlantic as “the blogger who saved the economy” due to the influence he had over the Fed’s late 2012 QE3 program. You can see a great overview of the rise of Sumner here:

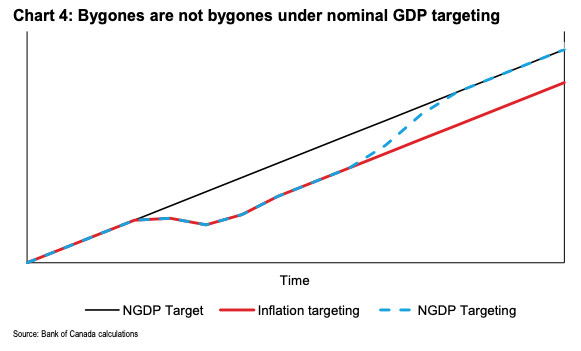

A key thing that he emphasises is that it’s not just the fact the nominal income is a more important variable for macro stability than price stability, but that the expected growth path of a variable is more important than a rate. In other words, if a central bank “misses” a 2% target the question is whether it tries to get back to 2% and consider that enough, or whether they try to get back to where things would have been had the 2% growth path continued. In technical terms NGDP advocates want a level target and, as Mark Carney’s chart below shows, to not let bygones be bygones.

(Astute readers will point out that you could have an inflation level target and achieve the same result, which is indeed the case. But for simplicity we compare the status quo inflation growth rate target and the potential NGDP level target).

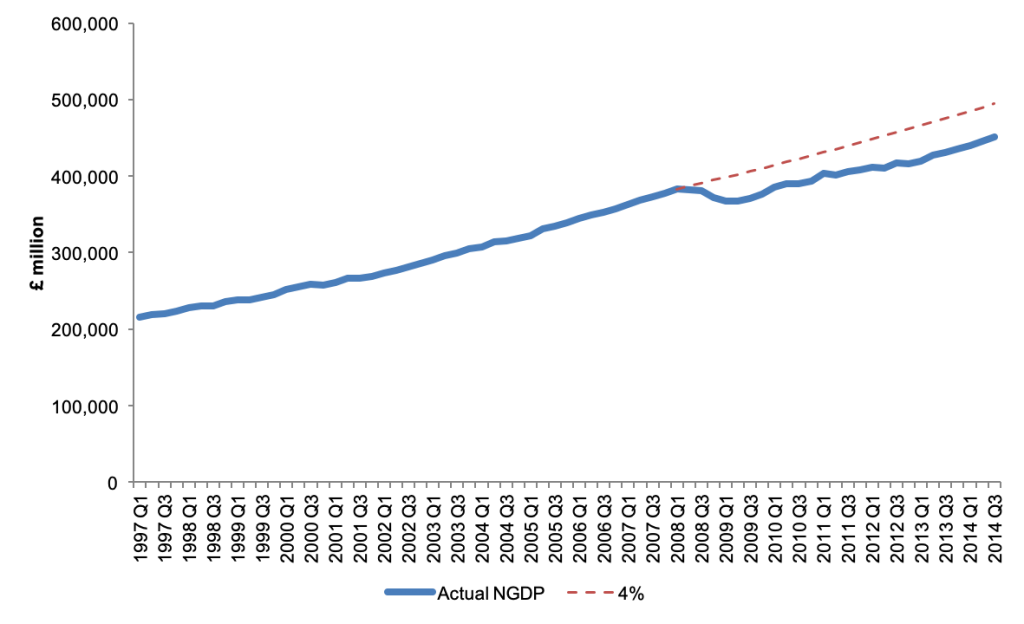

So even though thinking in growth rates is easier to communicate, the power of an NGDP level target is best shown when we look at absolute units. And as the chart below shows the UK deviated from a hypothetical 4% growth path and failed to catch back up again. That NGDP gap represents a permanent loss of economic activity relative to the public’s prior expectations, and forces an unnecessary and painful slowdown.

Source: ONS, own calculations

NGDP targets: pros and cons

We shouldn’t expect a perfect tool for managing the economy, so in this section I want to summarise what I consider to be the three strongest reasons in favour of NGDP targets, and also the three strongest arguments against.

Three good reasons in favour:

- They are good at dealing with supply shocks. An inflation target fails to reflect the reasons for inflation to either be above or below target, and therefore send dangerous signals to policymakers. If inflation is low because of a lack of demand, we need central banks to step in. But if inflation is low because of productivity improvements, then increased purchasing power is exactly what we want. Similarly, if too much aggregate demand is causing higher prices we want central banks to cool things down. But if a negative real shock is prompting prices to spike, the last thing we want is reduced spending, which which compound the negative economic activity. By asking central bankers to “see through” temporary inflation we’re expecting them to be able to make a judgment about the source of inflation. An NGDP target avoids having to do this – by keeping nominal income stable you let the price level adjust automatically to changes in productivity.

- They promote financial stability. A big macroeconomic danger is that when debt burdens become unmanageable this tends to affect wide parts of the economy and has negative knock on effects. A NGDP target means that in a recession inflation will increase and this will erode some of the real value of those debt burdens. People tend to borrow a nominal amount, and inflation means that you pay back less, in real terms, than you otherwise would. This eases the consequences of high debt burdens.

- They promote monetary neutrality. If V is people’s desire to spend money then we can recognise that it is the inverse of people’s desire to hold money, i.e. the demand for money. Like any market, equilibrium occurs when the demand and supply are able to adjust, and when it comes to money we want supply to adjust to changes in demand. Monetary equilibrium is therefore a consequence of NGDP stability. This also will keep interest rates at their “natural” rate, which is when the demand and supply of loanable funds is equal. Rather than using monetary policy to deliver an arbitrary inflation target, an NGDP target approximates a much more important macroeconomic objective: neutrality. It provides a platform where demand and supply interact, providing a stable and meaningful context for economic activity to take place.

Three good reasons against:

- National income data isn’t ready yet. Reasonably accurate estimates of CPI are released every month. GDP by contrast tends to be available each quarter and subject to large revisions. Indeed some people argue that policy mistakes in 2008 were more due to the fact that GDP data was faulty rather than a blind commitment to an inflation target. But even if we had quicker estimates of GDP this isn’t necessarily what we should be focused on. Not all economic transactions are captured in GDP figures, which is a sort of middle ground between a measure of pure consumption of final goods (i.e. no capital goods at all) and the entire capital stock. It serves a useful purpose, but is hardly an accurate measure of what we actually care about. Some would argue that the “correct” form of the equation of exchange is M+V=P+T, where T refers to all economic transactions. But if we include financial transactions in our analysis, the real economy becomes virtually irrelevant. So perhaps a focus on payments data or “average weekly earnings” may be better suited to our objectives than GDP.

- It will lead to greater inflation volatility. By switching to a NGDP target policymakers will be less inclined to ensure a stable rate of inflation. It’s debatable how successful they have been at delivering a low, moderate rate of inflation, but less focus on this may well reduce performance even more. Especially since Y* is subject to change, the choice of NGDP target will lead to quite high variations in inflation. There will also be some confusion amongst the general public, because at the moment we use CPI as our standard measure. However the “P” in M+V=P+Y is not best measured by a basket of consumer goods, it should be the inflation rate that affects the component parts of our GDP calculation. This is referred to the “GDP deflator”. It has taken central banks many years to generate credibility around their ability to get the general public to expect 2% inflation. Switching to a more volatile outcome of a different measure might be hard to explain.

- Not all economies are suitable. An NGDP target is best suited to larger economies, because smaller ones (especially if their are open to trade) are likely to be reliant on particular commodities. For example, for small open economies (in especially those that are commodity exporters) if oil prices rise you would need to shrink the rest of the economy.

Working on NGDP targets

In May 2013 I organised a conference in Copenhagen, hosted by Danske Bank. It involved Lars Christensen as well as Sam Bowman and Ben Southwood from the Adam Smith Institute. Lars coined the term “Market Monetarism” and became known as an early and influential advocate via his famous blog, “The Market Monetarist“. Sam advocated an NGDP target in a letter published by the Financial Times in 2014. And here is a nice video of Ben Southwood explaining how a NGDP target would mean that central banks don’t have to try to work out which shocks to respond to and which to ignore:

Also around this time, in 2016, the ASI published my policy report, Sound Money, which contained an NGDP proposal for the UK.

Some of the key questions to address when considering an NGDP target are as follows:

- Should it be a growth rate target or a level target?

- Should it be set at a high rate (which gives monetary policy more room to manoeuvre, and requires less of an adjustment from nominal wages in a downturn) or a lower rate (which permits mild deflation when productivity is high, and has less distortions on non-indexed factors such as taxes on capital)?

- Should it focus on GDP or some other measure of economic activity such as transactions, or something like Average Weekly Earnings?

- Should it focus on GDP/T/AWE as whole or adjusted for population growth (i.e. on a per capita basis)?

Considering all of these factors, I advocated a 2% average growth in NGDP expectations over a 5 year rolling period. The mains reasons were:

- It retains the public’s understanding of real GDP and inflation in terms of growth rates, not levels

- 5 years is a long enough time period to be a de facto level target

- 5 years is a short enough period to fit into the political cycle (and therefore generate some short term accountability)

- A 2% rate hedges against central bank incompetence at the zero lower bound

- A 2% rate provides a small cushion against deflation (which rightly or wrongly is politically dangerous)

- A 2% rate is low enough to permits a mild deflation whenever productivity grows above 2%

- It avoids the need (for now) to set up complicated futures market

My proposal was trying to strike a balance between those who advocate that total spending is stable (i.e. a 0% growth target) and those who take the current inflation target (2%) and the typical long term real growth rate (~2%) to create a 4% NGDP target. But this idea didn’t catch on, and in hindsight it’s probably better to go for one or the other. Regardless, I was delighted to see that the proposals received extensive media coverage:

It’s more than just a NGDP target

My ASI proposal discussed NGDP targets within the context of wider reforms. I viewed an NGDP target as a step in the right direction away from arbitrary and discretionary monetary policy decisions, and toward a more automated, rule-based system. Some important additional elements relating to implementation included:

- It places a focus on monetary base (which, ultimately, is all that the CB controls)

- It makes open market operations (OMO) the routine monetary policy tool (rather than interest rates)

- It can strip away a lot of distortionary CB activity

- It uses forecasts and market expectations (possibly through futures contracts) rather than historic data

- It can be tied to some automatic mechanism, become a rule, and eliminates discretion entirely

More recently

In June 2020 I participated in a webinar, hosted by the Adam Smith Institute, about NGDP targeting. I wouldn’t expect you to watch the entire recording, but it was a real thrill to share a panel with Scott Sumner.

In September 2021 Scott Sumner was interviewed by Larry White for the Mercatus Center podcast. I recommend the whole episode, but what I found most interesting was Scott’s optimistic take on the influence of NGDP targets. He made a few key points:

-

A flexible average inflation target is one way to permit NGDP playing a role without the embarrassment of abandoning an inflation target.

-

The Fed’s decision to cut interest rates in 2019, despite inflation being high, indicates an increased concern for market expectations (see falling inflation expectations here) and therefore a triumph of market monetarism. (Indeed market monetarists have been credited with having directly influenced the Fed’s decision to adopt average inflation targeting and use market forecasts when cutting interest rates in 2019).

-

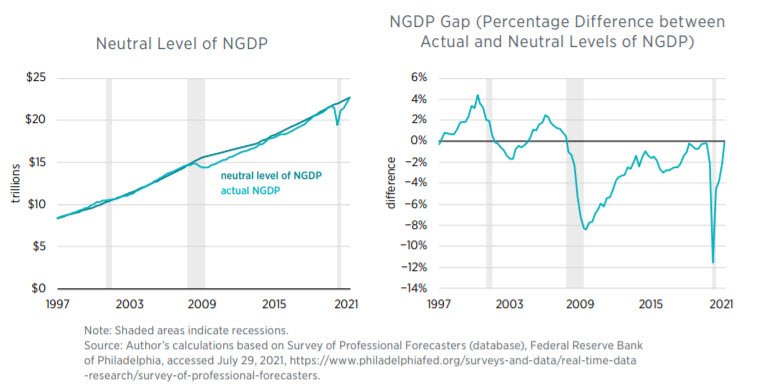

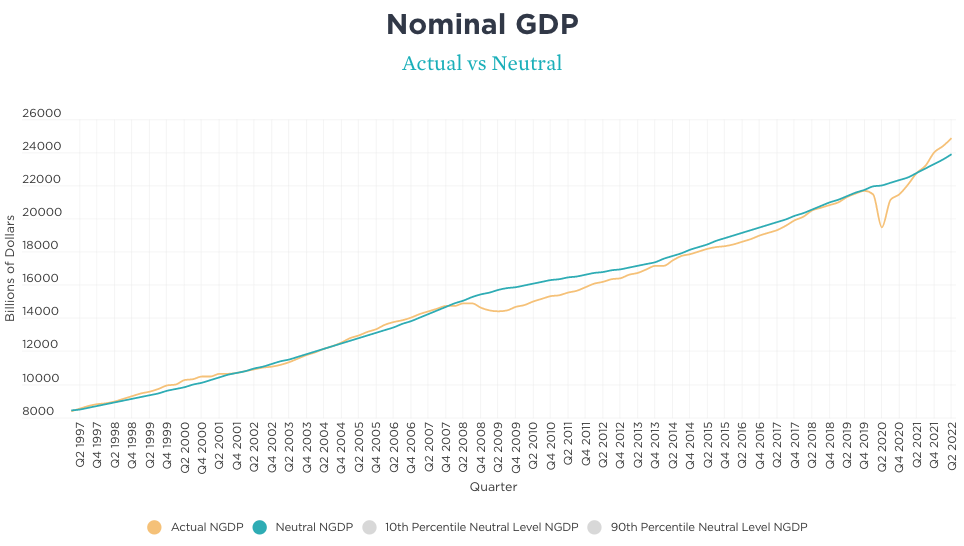

We’ve now got back to the pre-covid NGDP trendline (see David Beckworth’s charts, shown below) which is why this recession hasn’t prompted a debt crisis.

I don’t think this final point is appreciated enough – we’ve experienced a historically unprecedented collapse in economic activity and yet this didn’t have an immediate, obvious, and cataclysmic effect on the banking system, the housing market, unemployment, or corporate or personal bankruptcy levels. Had central banks repeated the mistake of 2008, and allowed NGDP growth expectations to fall, then the consequences would have been horrific. But they heeded the lesson, and reassured markets that NGDP would soon return to the previous trend path.

That said, if we look at the figures for 2022 we can see that according to David Beckworth’s excellent data set actual NGDP is now exceeding the amount it would be in order to be neutral. This suggests that the Fed are providing too much support, risking higher inflation and financial exuberance.

Source: David Beckworth. https://www.mercatus.org/publications/monetary-policy/measuring-monetary-policy-ngdp-gap

Whether or not central banks adopt an explicit NGDP target this data is playing a crucial role in our attempt to assess and inform policy decisions. I’m proud to have contributed to this research agenda.

Further recommendations:

Podcasts:

- Lawrence White & Scott Sumner on “The Money Illusion”, FA Hayek Program podcast, September 2021

- The Fed Framework Review, Macro Musings, January 2025 – this is an edited collection of past shows that discussed NGDP targets.

Recommended video:

- What can asset prices tell us about the great recession? Scott Sumner, February 2011 – a great way to see how Scott’s interpretation of events during the financial crisis were seen as idiosyncratic, but now look highly prescient.

- The Role of the Fed, December 2012 – David Beckworth and Scott Sumber present a congressional testimony about market monetarism.

- What does nominal GDP entail? IEA, August 2016 – a short interview with Scott Sumner about how expectations relating to nominal income grwoth are an important tool for central banks when interest rates are low.

️ Relevant newspaper opinion:

- “The Simplest Way to Improve Monetary Policy” by Clive Crook, Bloomberg, April 8th 2022

Relevant academic articles:

- Frankel, J., 2019, “Should the Fed be constrained?” Cato Journal, 39(2): 461-470

✍️ Other things I’ve written

- Did the NGDP crowd win the battle of ideas? Kaleidic Economics, December 27th 2021

- Understanding NGDP targeting Kaleidic Economics, June 24th 2020

- Sound Money, An Austrian proposal for free banking, NGDP targets, and OMO reforms, Adam Smith Institute, 2016

Useful data:

- Mercatus Center Data Visualisation: The NGDP Gap, by David Beckworth

- US NGDP, FRED

- UK NGDP, ONS

️ White paper

- I have written a white paper called “Delivering nominal stability” which is available on request

Test you knowledge:

Business Economics – emlyon

This course gives participants a coherent view of core economic concepts from the perspective of managers and policymakers. We will look at the principles of microeconomics that are relevant for managerial decisions, including value creation, supply decisions, and the use of markets to allocate scarce resources. Particular techniques involving the interpretation of market data will be explored to provide a useful, practical toolkit.

The course also exposes participants to some of the key frameworks and models in macroeconomic theory, and provides a policy-oriented decision-making context. Newspapers and social media are full of macroeconomic commentary, but many people can feel intimidated by the terms being used and the thinking behind them. Participants will not only understand why certain decisions were made, but formulate their own views on the arguments in favour and against. In doing so, participations will be obliged to think big about the macro policy environment.

Finally, economics is focused on human action and therefore we will look at some key findings from the behavioural economics literature and how they relate to corporate decision making.

Course textbook:

- Evans, Anthony J., 2020 “Economics: A complete guide for business“, London Publishing Partnership

Course handouts: download here

Assessment instructions: download here

Schedule: download here

| Pre class activities |

Here is a list of all of the pre-readings:

You should consult the schedule below to see additional instructions for each of these readings. There are also links to relevant sections of the textbook but these are not mandatory. To verify you have the maths skills necessary for this course, complete this quiz. |

| Day 1: Micro |

1. Value creation* (+)

2. Cost curves* (+)

3. Auctions (+)

4. Market applications (+)

Extra activity: The Dutch flower auction |

| Day 2: Macro: closed economy |

| Before the course begins you should watch this video on Prediction and pass this quiz.

5 & 6. Monetary policy* (+)

7 & 8. Fiscal policy* (+)

After class you should watch this video on Macro Policy and pass this quiz. Extra activity: NGDP Masterclass |

| Day 3: Macro: wider issues |

| 9. Macro Policy Workshop (+)

10. International economics (+)

11. Behavioural Economics* (+)

12. Behavioural Economics (contd.) After class you should watch this video on Credibility. |

| Revision |

| An optional online version of this course, which may be helpful for revision, is available here. |

Note:

Sessions marked with an asterix (*) are lectures and have handouts available. Cases marked with a pound sign (£) are available via Canvas. Each session contains a link (+) to additional resources.

Extra

Mountain biking in Lyon

The food in Lyon

Macro Models

| Lecture handout: Macro Models: from DICE to doughnuts |

This session integrates ecological concerns wirth standard economics, providing an overview of how macroeconomists model the economy and how those methods and models relate to climate issues.

For a history of the Phillips curve, listen to:

- How the Phillips Curve shaped macroeconomics, Planet Money, September 8th 2023

Here are the scorecards on social progress mentioned:

In some versions of this presentation I discuss agent-based models. You can play with the Schelling model here. To learn more about ABMs I recommend this Runestone Academy interactive textbook. Also see:

- “Why Agent-Based Modeling Never Happened in Economics” Mike Makowsky, March 2022

- Axtell, Robert L., and J. Doyne Farmer. 2025. “Agent-Based Modeling in Economics and Finance: Past, Present, and Future.” Journal of Economic Literature 63 (1): 197–287.

Further readings:

- Boulding, K.E., 1977, “Notes on goods, services, and cultural economics” Journal of Cultural Economics, 1(1):1-12

Recommended audio:

- “Macro 6: DSGE“, Anthony J. Evans (for more depth on Macroeconomic models including my other podcast episodes see here)

Recommended videos:

Here is a fascinating video (in French) on the limits to growth and the World 3 model

Here is Ray Dalio’s 30 minute explainer on his economic framework:

Quiz:

Here’s a short quiz to test your knowledge about the sessions:

https://forms.gle/7gS6wzAuUxirvKJ57

| Learning Objectives: Consider the upper limits of economic growth and the impact of economic activity on the environment. |

Markets: beyond AI

|

| A. Introduction |

| What if I told you that we have access to a technology that generates, aggregates and communicates a vast array of information in a single and simple to understand metric? That throughout human history we have experimented with, developed and deployed institutions that convert a multitude of different perspectives into a common, universal language? And, perhaps most importantly, that our intuitions about it are usually wrong? This unit gives you the ability to recognise the beauty and power of market prices and see your business environment in a whole new way. We will consider the social function of markets and their impact on facilitating an extended order of cooperation. We will also consider the key challenges that business practitioners will need to overcome to ensure that humanity continues to reap the rewards of one of our greatest collective accomplishments.

Markets don’t approach or have the capacity to exceed human intelligence, they are even better than that – they are a virtual collective intelligence. This short course intends to convince you of this remarkable claim. And, to demonstrate that I’m not a luddite, it is the only course I teach that deliberately incorporates AI generated content (the images above!) *** This website collects a range of resources for you to work through at your own pace. But if you take the in person version: Part 1 of the lecture handouts can be downloaded here. Part 2 of the lecture handouts can be downloaded here. |

| B. The foundational texts |

In this part of the course you should become familiar with four key foundational texts that articulate the majestic properties of markets.

To make things easier, I have republished them all in a single PDF file: Download the reading pack here. Here are short video explanations of the four key readings: Origin of Money, by Carl Menger The Use of Knowledge in Society, by FA Hayek I, Pencil, by Leonard Reed Seen vs Unseen, by Frederic Bastiat Test your knowledge of each reading with these four assignments: There is also a combined Kahoot! quiz for the in person version. |

| C. The modern relevance |

| Here is the trailer for Arrival (2016), which you should watch in full if you can.

Read: Catching Crumbs from the Table, by Ted Chiang, 2000 (Nature, 405, 517) Chiang’s work of science fiction takes place in a world where AI have grown beyond human’s ability to comprehend them, and scientific endeavour is simply an attempt to interpret what “metahumans” are doing. In this world, these intellectually superior beings are benign (he pointedly comments that “unlike most previous low technology cultures confronted with a high technology one – humans are in no danger of assimilation of extinction) but have no interest in communicating effectively with people like us (and indeed when you consider our attempts to explain scientific progress to ants, why should they?). He considers a technology that might help individuals to upgrade their cognitive capabilities to bridge this divide, but recognises that people are quite cautious about exposing children to any gene therapy that might lead towards assimilation. His vision is a technologically optimistic one, but where humans are resigned to “catching crumbs from the table” – to feed off the scraps of our superior machines, where our attempt to merely interpret and make sense of their findings is our limit. Read: Catching Crumbs from the Market, by Ben Southwood, 2022 In his attempt to understand the financial market reaction to the UK government’s infamous mini-budget in September 2022, Ben Southwood (an Editor at Stripe Press, and a friend of mine) explains his affection for Chiang’s article. In doing so, he asks “Aren’t we already catching crumbs from the table?” Indeed, as the readings above demonstrate, the information content provided by market exchange is not always given to us in an entirely intelligible manner. We must interpret market data, and indeed speculate on what it means. Markets are arenas for such speculation to take place, and for contested claims to confront reality. Unlike an artificial intelligence, markets are a product of of human action, but they are not of human design. Markets help to assimilate dispersed and fragmented information into a single figure, which relates to an entire constellation of price signals. This communication system helps us to act and to plan, without having to understand where it has come from or what has happened to make it change. The implications are clear, but the interpretation is not. We struggle to make sense of what we see, despite the awe we should have for the system. *** I remember hearing someone describe markets as “the first AI” and being impressed, but unconvinced by that declaration. Indeed here are some examples of people making an explicit link between markets and artificial intelligence. Firstly, Brad DeLong: “There is no better way for harnessing the eight-billion-brain anthology intelligence of humanity to achieving the social goals we all want, other than to organize a well-functioning market system. That is a basic and serious truth.” Brad DeLong (Conversations with Tyler. A similar quote can be found in his book ‘Slouching Towards Utopia’, 2022, p. 515) And consider this quote by Paul Seabright (The Company of Strangers, 2004, p.15): “Citizens of the industrialized market economies have lost their sense of wonder at the fact that they can decide spontaneously to go out in search of food, clothing, furniture, and thousands of other useful, attractive, frivolous, or life-saving items, and that when they do, somebody will have anticipated their actions and thoughtfully made such items available for them to buy. For our ancestors who wandered the plains in search of game or scratched the earth to grow grain under a capricious sky, such a future would have seemed truly miraculous, and the possibility that it might come about without the intervention of any overall controlling intelligence would have seemed incredible. Even when adventurous travelers opened up the first trade routes and the citizens of Europe and Asia first had the chance to sample each other’s luxuries, their safe arrival was still so much subject to chance and nature as to make it a source of drama and excitement as late as Shakespeare’s day.” Mark Zuckerberg talks about how stock markets resemble AI here:

But markets go way beyond an “artificial” intelligence. It is much more magnificent and mysterious: it is a virtual collective intelligence. One of the oldest in the world, and one of the most sophisticated social tools that man has ever created, our steps into the digital future might be trodden along a familiar path. How we understand and utilise markets are a useful way to practise and anticipate our relationship with the coming AI revolution.

“The market” isn’t a god or a weapon. It is neither something to worship nor something to deploy. It is an emergent and spontaneous order that helps us to solve social problems. |

| D. Markets in the age of AI |

| But what about the implications of AI for markets? Might modern technologies make markets obsolete? A hot topic in economics is whether improvements in big data and/or AI might alter the outcome of the socialist-calculation debate. Steve Horwitz explains that debate here:

The best book to read about the socialist calculation debate is:

Recent literature includes:

In 2024, Peter Boettke, Rosolino Candela, and Tegan Truitt published a book on the ongoing relevance of The Socialist Calculation Debate. A key quote: “Effective allocation of resources requires that there is a correspondence between the underlying conditions of tastes, technology, and resource endowments, and the induced variables of relative prices, quantities, and methods of production” (p.37) According to a 2024 working paper by Cass Sunstein, “In important respects, the Socialist Calculation Debate and the AI Calculation Debate are the same thing.” My view is that calculation problems can’t be solved through computation, and anyone who thinks that socialism is feasible either hasn’t read, or hasn’t understood, the four articles mentioned in this unit. Boettke et al (2024) write, “the whole point is that this has never been a computation problem. The knowledge is not “out there” and difficult to collect, but emergent only with the process itself and outside that context does not exist (p.60). As Martin Wolf has said, “Even in the age of big data, markets exploit knowledge and adjust incentives in ways that no other social media mechanism does” Martin Wolf (2023, p. 225) Indeed, this isn’t a new debate at all. Good examples of papers claiming that AI or big data could replace markets include:

And good rejoinders include:

Other shorter contributions to this debate include comments by: Here is a video on this topic featuring Bob Murphy:

Finally, in January 2025 the sudden popularity of Chinese AI app DeepSeek prompted a slump in US tech stocks. Read this BBC News report and consider the important role that market prices play in explaining what happened and why. |

| E. Conclusion |

| Markets are robust and powerful and in many cases using markets to try to solve a problem will make a massive contribution to actually doing so. What’s more, since most people’s intuitions about markets are wrong, we have immense potential to not only change people’s view of the world but also discover an important social tool.

This often constitutes a viewquake! |

| F. Testimonials |

| “Markets: Beyond AI” was a resounding success, perfectly aligning with our mission by blending academic depth with practical relevance. Anthony expertly unraveled the complexities of market dynamics, illustrating how prices act as a vital mechanism for encapsulating intricate economic data to guide decision-making and spur innovation. His talent for making such a nuanced concept accessible and interactive was highly impressive. The workshop inspired and educated in equal measure.

Javier Gonzalez, Dept. of Economics, Universidad de Sonora, Hermosillo |

| G. References |

| Wolf, M., 2023, The crisis of democratic capitalism, Allen Lane

DeLong, J. B., 2022, Slouching towards utopia, Basic Books |