Tip jar

☕️ If you have enjoyed any of these resources, feel free to buy me a coffee.

☕️ If you have enjoyed any of these resources, feel free to buy me a coffee.

There are widespread concerns that social and political divisions are being exacerbated by information technology, and that this is having a profound impact on the capabilities and quality of both global and local institutions. In a similar way to how the advent of the printing press prompted the rise of democracy and the nation state, perhaps digital transformation is contributing to a similar disruption in governance.

Such trends are particularly relevant in regimes where statehood was not an internal process, and was adopted either through colonial or international activity. Rising populism and authoritarianism provides the social and political backdrop to our analysis of the broad impact of technology, and we will consider whether pluralist approaches may help to combat some of the emerging threats to liberal democracy.

This course investigates how digital transformation relates to democracy and governance in an increasingly connected yet potentially polarised world.

For a good example of a subject matter for the group report I highly recommend reading The Story of VaccineCA. In particular, consider how the following elements coincide: the type of organisation chosen to pursue this objective (initially volunteers but then a Delaware corporation; the institutional context (i.e. liberal market democracy where sharing such information wasn’t illegal); and the cultural attitude toward problem solving and tech optimism. For a great interview with Patrick McKenzie about his background and advice listen to his Conversation with Tyler.

Students should have already taken my 6 hour component of the Business Frontier Technologies course. This includes some of the following content:

For a 50 point quiz to test your knowledge of the pre-readings see here.

To understand some of the context for my construction of this course I recommend:

Famous documentaries about Facebook include:

Here is the Brexit movie mentioned in class:

Here are US political strategists talking about micro targeting:

Here is David Rand’s talk on misinformation:

This documentary looks at the Arab spring:

Here is Coltan Scrivner’s explaining the evolutionary purpose of paying attention to true crime:

Here is Patri Friedman arguing that we should be able to start new countries as easily as starting a new country:

“I spent 10 years at Google… I think we should be able to start new countries as easily as we start companies today.” pic.twitter.com/IcsOgRJH9z

— Freethink (@freethinkmedia) August 11, 2022

This is not massively related to this course, but I really enjoyed watching Top Gun: Maverick (you may need to watch the original Top Gun first to get the full benefit). It reminded me of how Rocky IV contrasted American individualism, authenticity, and heart against superior Soviet technology. I saw Maverick as a rumination on automation, and the continued role for human emotion, and decision making that is instinctive, impulsive, and emotive, and how that gets managed. The subtext is that unmanned drones and algorithms are the future. In the film, US technology is deemed inferior but it is all about who is in the plane and not the plane itself. Traditional pilots needs to eat, sleep and piss but remain the driving force of future success, and whatever is is that ensures a future is worth achieving.

Here’s an absorbing and fascinating explanation of how the Mach 10 scene resembles a perfect pop song:

The best 3 movies related to AI and our conception of reality (in my opinion) are:

Perhaps the best case study of the importance of an effective digital transformation is the UK Post Office Horizon scandal (Wikipedia). There is an excellent podcast about it produced by BBC Sounds and in January 2024 ITV aired a documentary.

Priyanka Dalotra (LinkedIn)

If you wish to work in the public sector I recommend the following resources:

The MIT Press Essential Knowledge series contains a number of titles that are relevant for this course. I particularly recommend:

The Ostrom Workshop has some good resources on Polycentric Governance.

If you detect an attempt to link together the claims that “an important solution to social media addiction is good parenting” and “we have to learn how to raise AI” then this is deliberate. Indeed Stuart Ritchie (who works at Anthropic) captures it perfectly:

And it’s apt that I teach this course at ESCP. As Martin Luther said, Paris is “the parent of learning”.

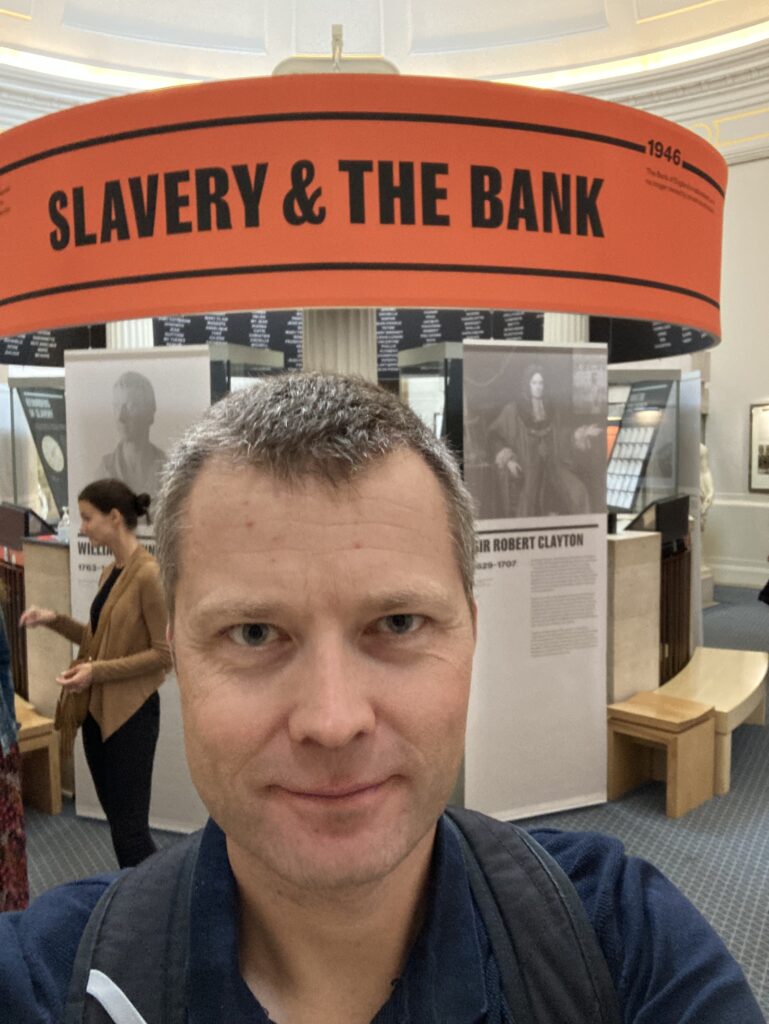

I have been to the Bank of England Museum several times and highly recommend it. It provides a good overview of the Bank’s history, contains interactive content, and has special exhibitions. Situated in the basement of the Bank (and therefore very close to the eponymous underground station) it’s open on every weekday and even opens late every third Thursday. The best part: it is totally free!

My most recent visit was in June 2024.

I started by looking at early examples of currency. Gold coins originate from c7th bc in Lydia (now in modern Turkey) and here is my photo of one of the first:

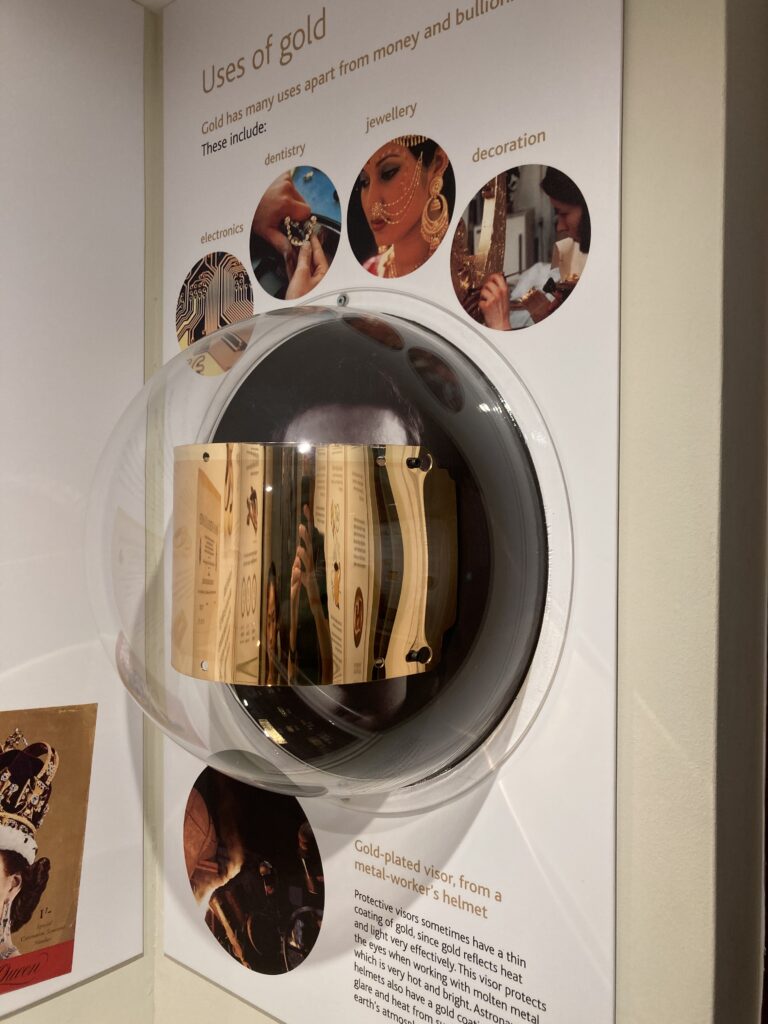

The museum has a section on the historic non monetary uses of gold. Here is a photo of a gold-plated visor from a metal workers helmet:

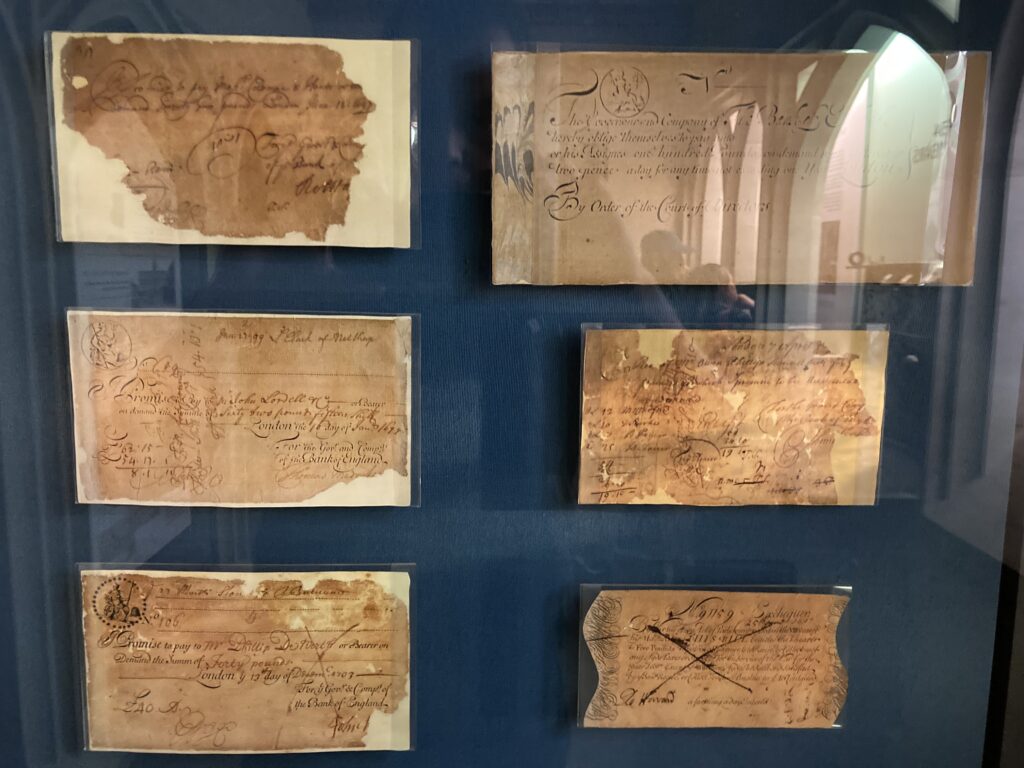

The bank’s notes originate from 1743 and the most popular types served as a type of payable receipt, that would enable the holder to redeem coin deposits. Here are some examples of early bank notes:

Notice how some are torn in the bottom corner. As this page explains, this shows that the balance has been paid.

Notice how some are torn in the bottom corner. As this page explains, this shows that the balance has been paid.

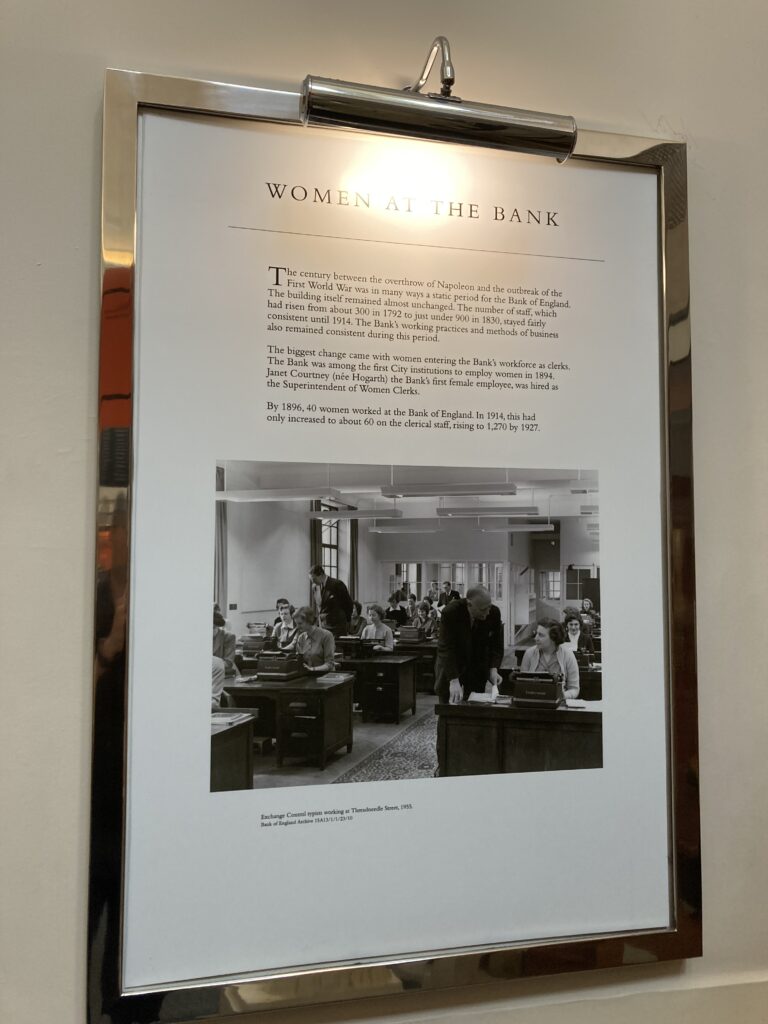

I was very pleased to see a section marking the history of women at the bank. The first female employees started in 1894, and the bank was one of the first institutions in the City to employ them.

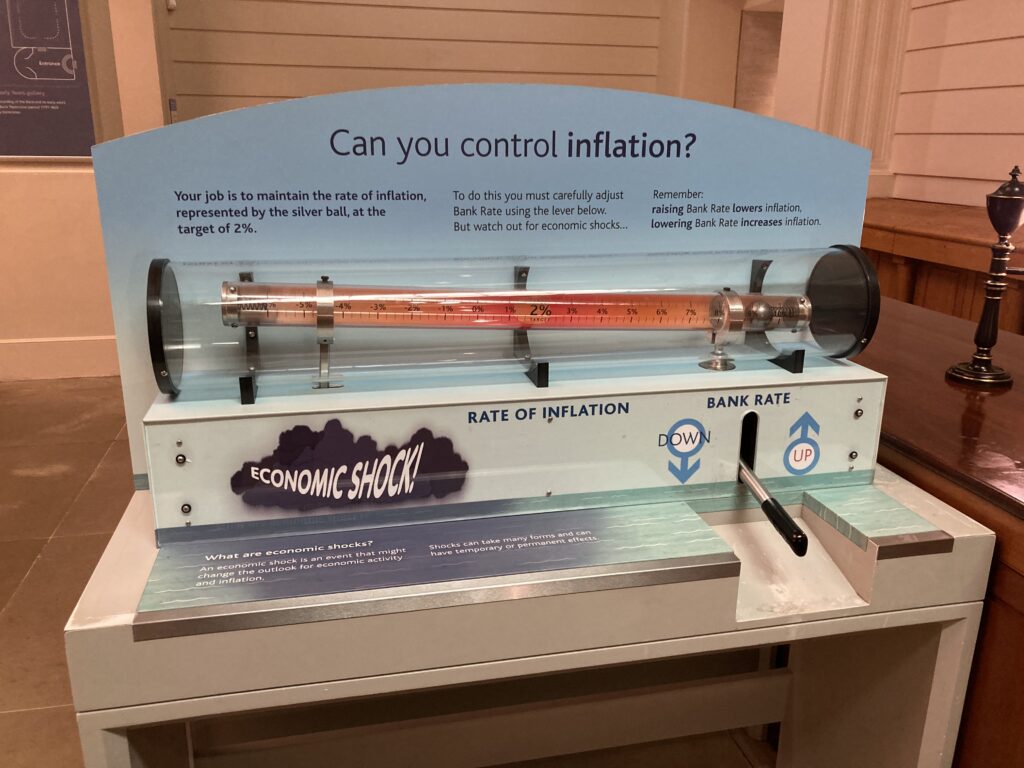

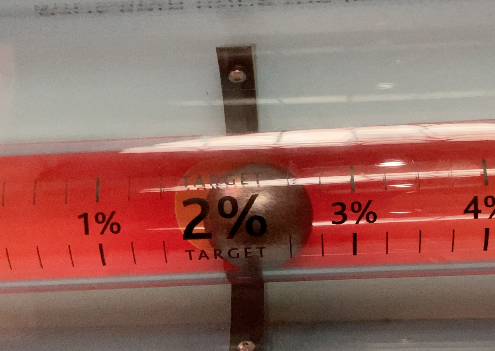

My favourite part of the museum is the attempt to explain how monetary policy works. This machine gives visitors the chance to play the role of the Monetary Policy Committee (MPC) and move interest rates up or down depending on how close inflation is to the target.

As you can see, I wasn’t very good!

But I did get it in the end!

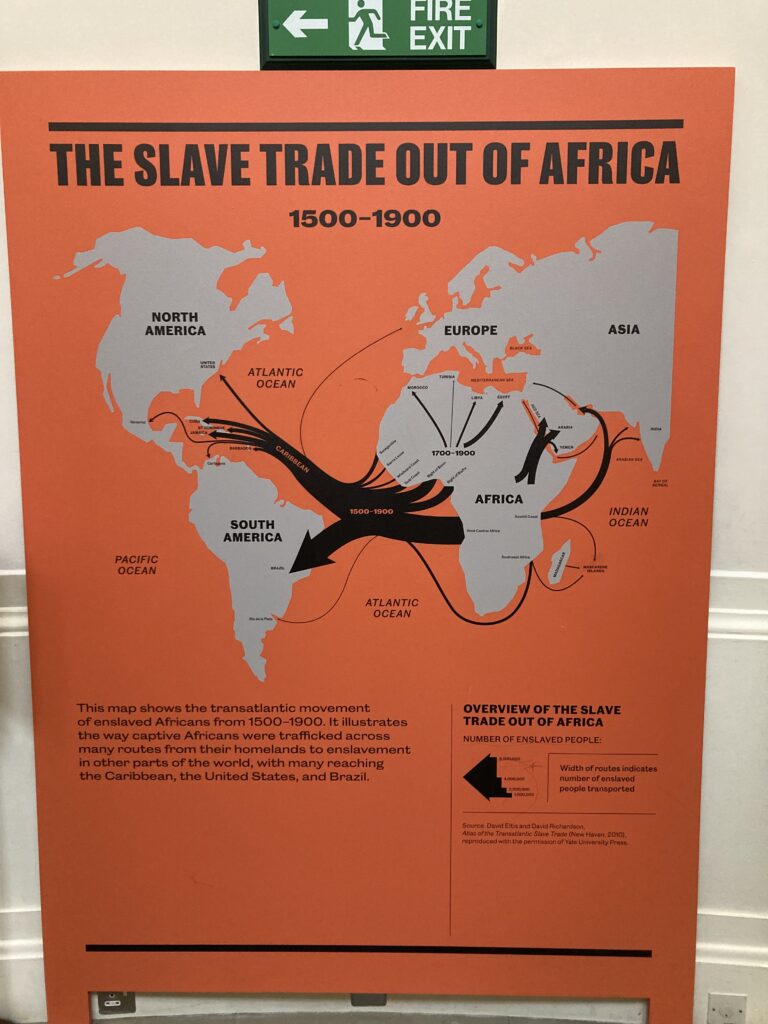

While I was visiting there was a special exhibit on slavery and the bank. Over a 300 year period the global slave trade took over 12 million Africans from their homes, and this map reveals the scale.

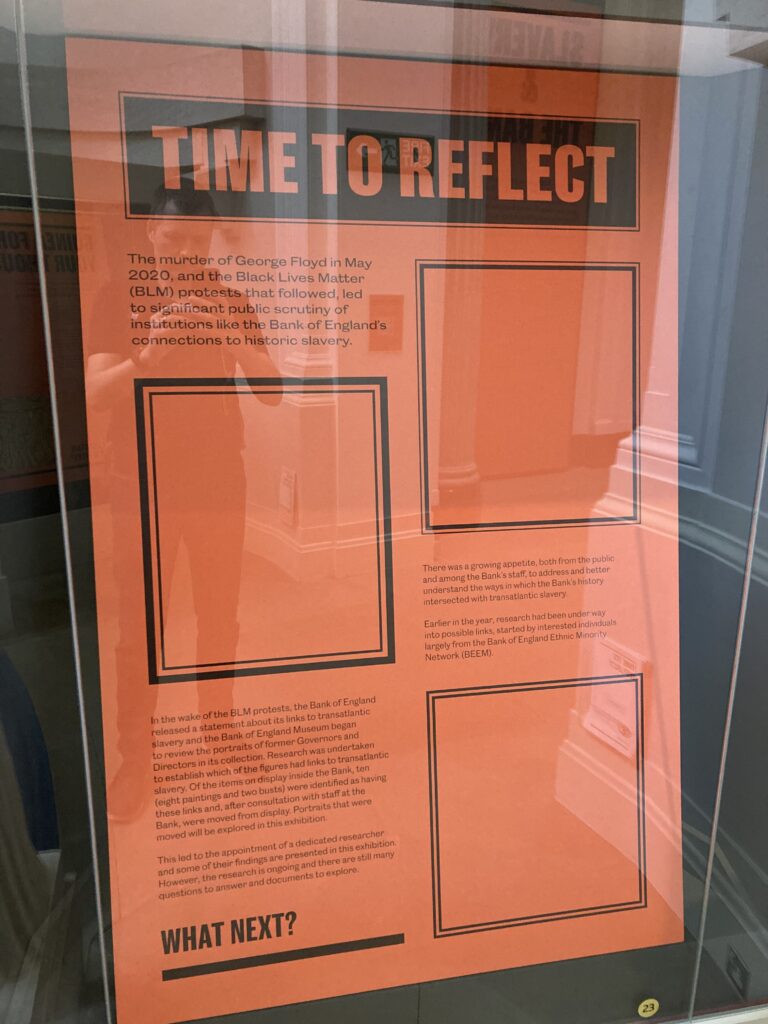

I didn’t learn much about the banks role, but I was encouraged to reflect:

I hope you enjoyed my tour as much as I did. Please consider visiting the museum for yourself!

You can take a short quiz to test your knowledge here:

I was saddened to learn that The Museum of Neoliberalism is closing (see here). It is located near Lewisham and I visited in November 2023.

In this article I wanted to share 5 points that came to mind as I looked around.

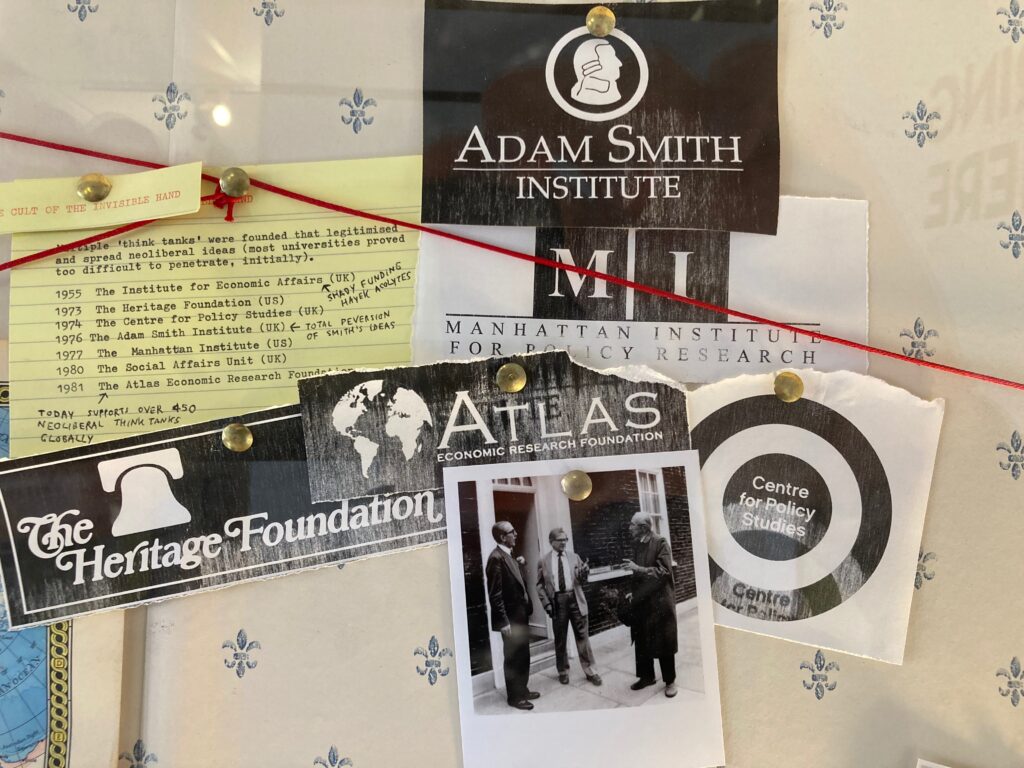

(1) There is a tendency for critics of neoliberalism to present a conspiracy theory view of the movement. The museum presents this in the following way:

I mean, they even used red thread!

The serious point is that these outside accounts don’t match my inside knowledge, and I don’t believe that’s due to naivety on my part. I’m a senior fellow of the Adam Smith Institute and disagree that they constitute a “total perversion of Smith’s ideas”, but welcome an intellectual conversation about that claim. Back in 2016 Sam Bowman (then Executive Director at the ASI) wrote an article called “I’m a neoliberal. Maybe you are too” and yet I’ve not seen an honest engagement with that.

Ultimately, I think that the truth is less exciting than the museum depicts – these think tanks are transparent with their objectives and activities, punch above their weight in terms of resources, but have little direct power or influence. It’s an error to present them as something they are not.

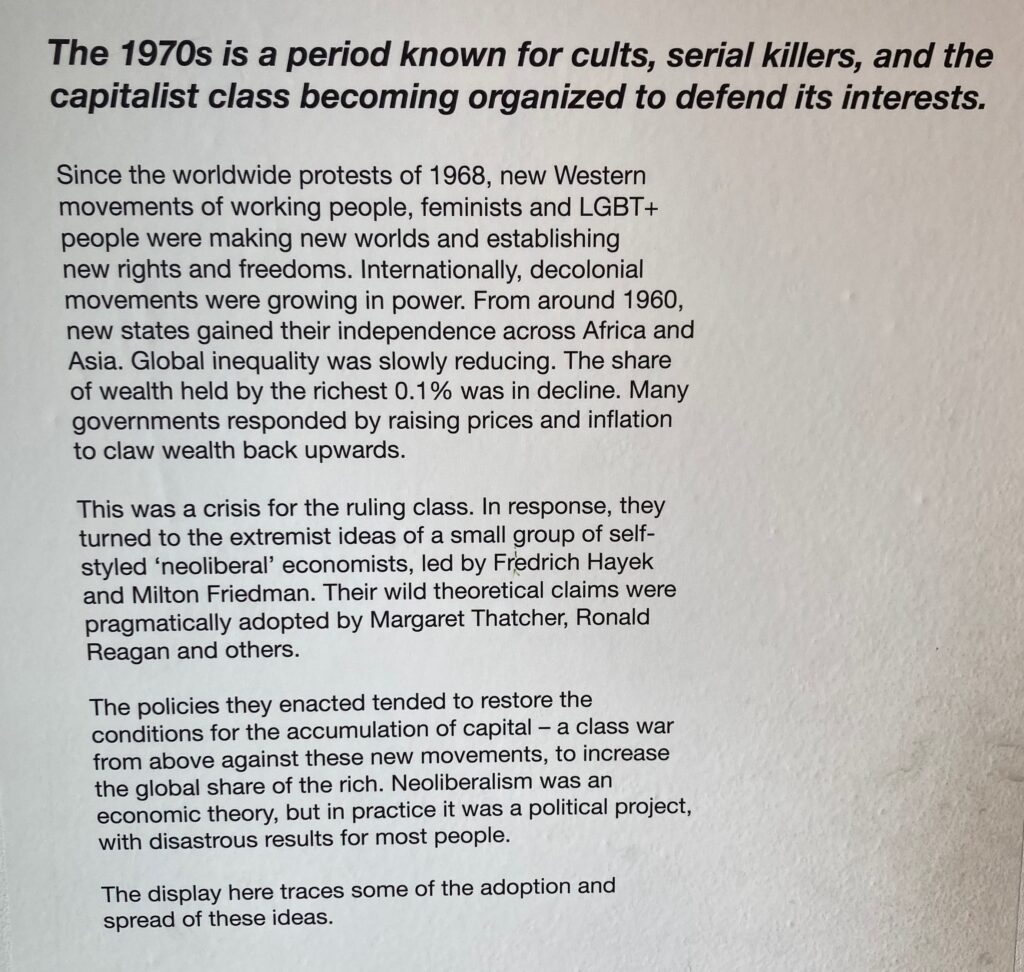

(2) There is lots to be said about what has happened to economic inequality (and why) over the course of the twentieth century (my teaching materials are here). But the idea that governments responded to falling inequality by increasing prices is simply wrong.

Milton Friedman’s monetarist prescriptions were a response to the prevalent inflation, and succeeded in controlling it. That inflation was a result of excessive money creation, in part due to the fiscal profligacy of government spending. The chronology is clear – neoliberalism gained dominance within the context of high inflation, and sought to combat it. It did not generate inflation as a means to reverse declining inequality.

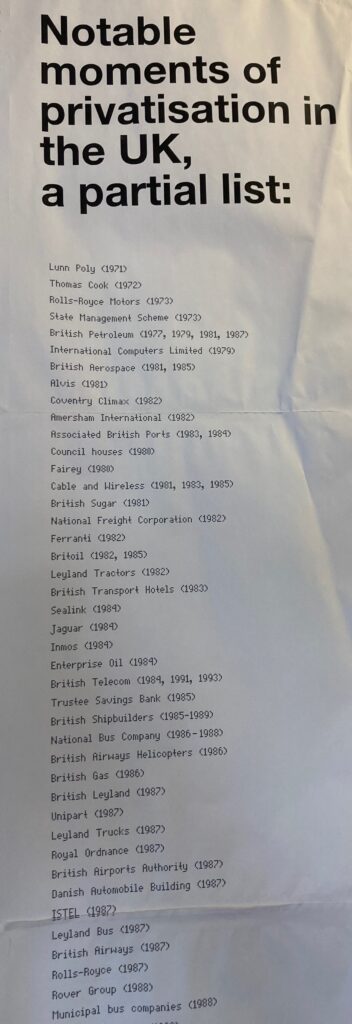

(3) There is a long list of notable moments of privatisation in the UK. I suspect the assumption is that because privatisation is unpopular, this is persuasive. However, the paradox of privatization is that although most people believe that the process by which assets are returned to private ownership is often flawed, they typically do not want the state to control those industries. (Note that the solution, therefore, is to avoid nationalisation in the first place.)

But when you actually look at these companies – Lunn Poly, Thomas Cook – does anyone really want state ownership of travel agents? Is Rolls Royce really a company that the UK government should run? Really?

(4) The section on “bullshit jobs” exposes poor working practices and elicits sympathy for workers who lack certain employment rights.

In my view, though, the last thing you should do in such situations is to remove options. And yet this is what higher labour standards, by imposing costs on employers, tend to do. Ultimately I find these sorts of judgments elitist and snobbish. There’s a million jobs I’d hate to do, but any job that someone voluntarily agrees to, because they view it as an improvement over their next best alternative, is ok by me. Generally speaking, the gig economy has been a liberation within the context of excessive restrictions on labour.

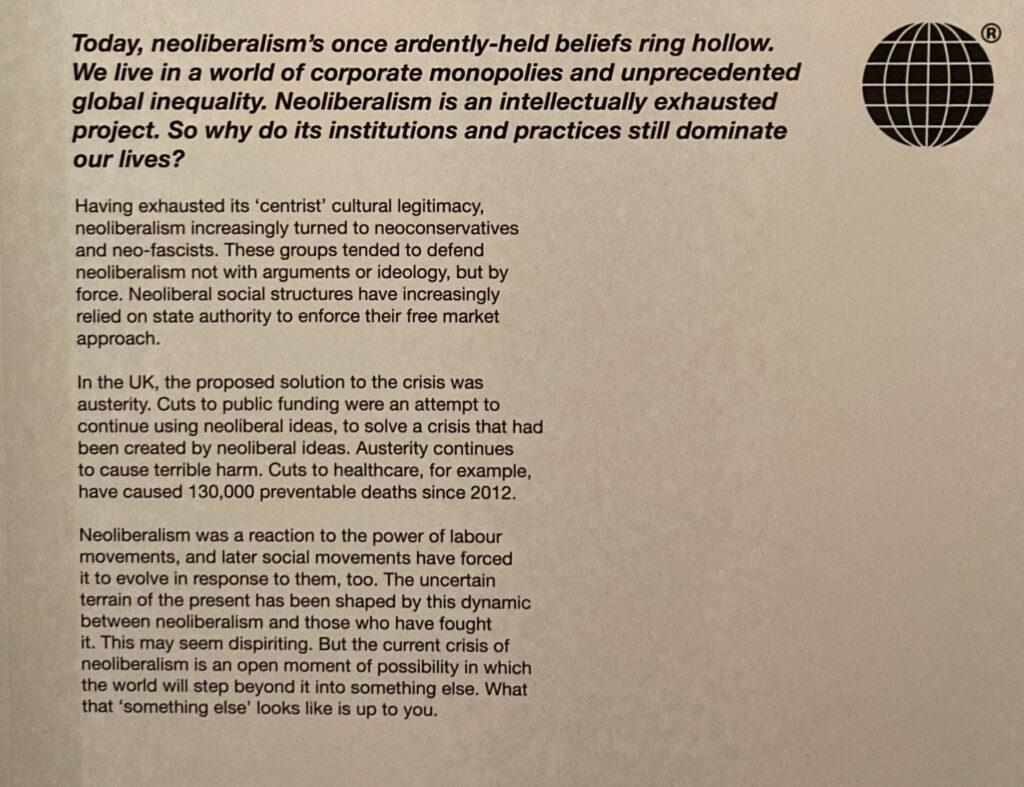

(5) And what’s the conclusion? Well this final panel, called “there is an alternative” sums things up nicely.

Apparently

“the current crisis is an open moment of possibility in which the world will step beyond it into something else. What that ‘something else’ looks like is up to you.”

Forgive me, but I do not see an articulation of an alternative. This does nothing to dispense the fear that the only plausible alternative to a free market system of private property rights is a utopian nonsense.

So although I take issue with the presentation of evidence and the underlying narrative, I admire the concept of a Museum of Neoliberalism and I am sorry that it is closing.

I’ve been regularly visiting Zagreb for over a decade, and have noticed that it is unique for three main reasons:

(1) The old town – all nice European cities have an old town, but five things make Zagreb’s particularly memorable.

The Funicular is the shortest in the world and Zagreb’s first form of public transit.

©Vladographer/Getty Images Plus

The Gric cannon fires at 12:00pm every day, and has done for for over a century. Kaboom!

The Stone Gate is in the upper town and displays an icon that supposedly survived a fire in 1731 (see here). Here is a photo of the stone gate from the 1940s:

The Gric tunnels are handy ways to pass through parts of the centre. I first heard about them from an episode of one of my favourite YouTube series, Cockpit Casual.

Croatia (as in “cravat”) invented the tie. See more here.

(2) Weird museums – Zagreb is home to several bizarre sounding museums, all in the centre of town. I’ve been to most, but am not sure what order to list them here. The perfect night out?

(3) Festival of light – held in March each year, the festival marks the arrival of Spring and includes installations throughout the city. The use of light in public spaces is a theme in Zagreb, as you can see from the display on the Hendrix bridge:

Finally, here are some ad hoc recommendations:

Music

Movies

| Lecture handout: Sustainability |

Here’s how to visit the grave of J.B. Say. Here is a photo from a book written by Richard Cantillon, published in 1755, which uses the word “entrepreneur”.

Here is the Outdoor Boys video about building a snow shelter:

Here is the Bushradical video about building a log cabin in the woods:

Here is a video on poverty being a lack of cash, not a character trait:

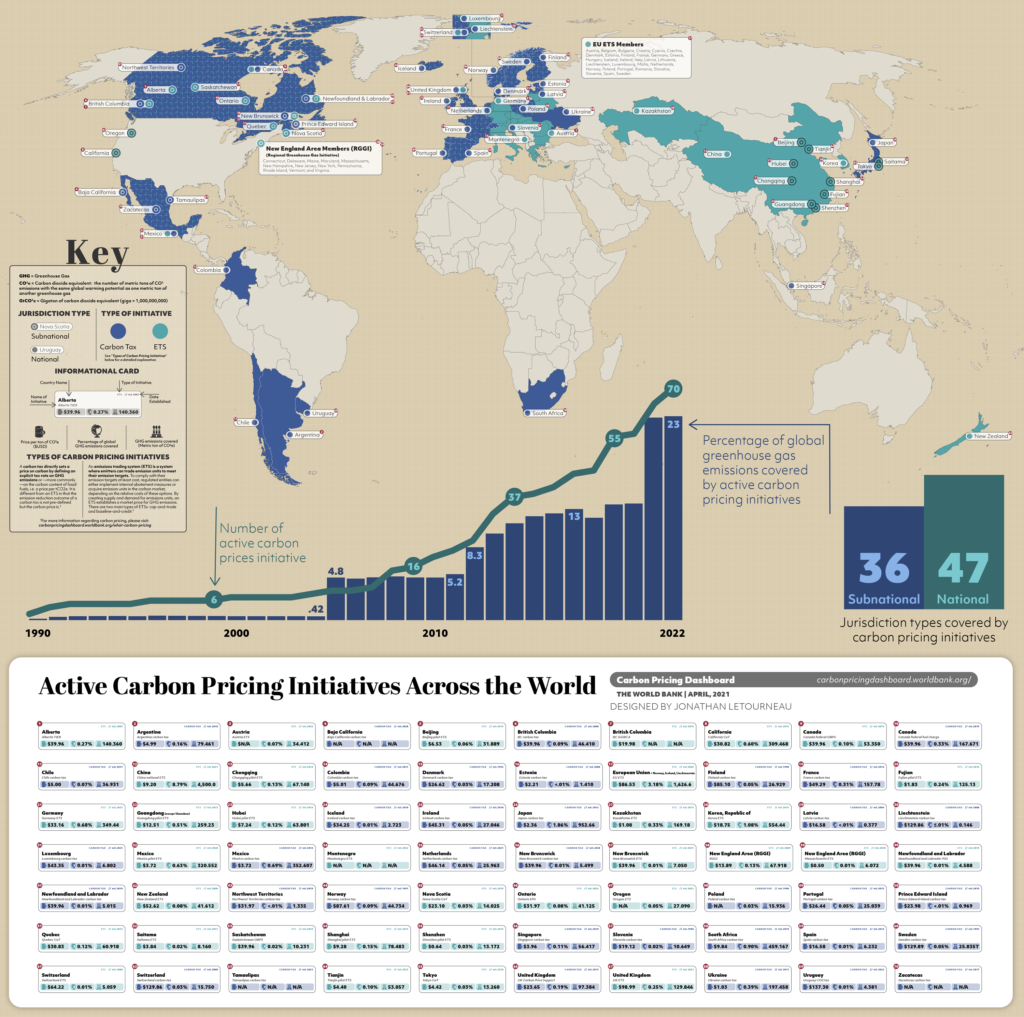

Here’s a nice visual showing different carbon pricing initiatives:

After the collapse of communism there was a well-known problem within the environmental movement,

“Creating Green parties in much of Eastern Europe was a uniquely difficult process, in large part because of “melons” and “cucumbers” (melons are green on the outside but red inside; cucumbers are green all the way through” (Feffer, J., 1999, Shock Waves, p.171)

In October 2025 Nature published the following article:

It’s really quite remarkable that the world’s most prestigious scientific journal published what is little more than a consultanty op-ed.

Here is a TedX talk about the doughnut model:

Some spinning donuts (you see! it is meant to be measured after all!):

Yes! At last… Watch national Doughnuts changing over time. Published today: 150 countries, 1992-2015. Eye-opening & powerful work by @AndrewLFanning & coauthors. Check out the website – an incredible teaching resource… https://t.co/8D59jZ9TMp pic.twitter.com/PwMYZwHc3g

— Kate Raworth (@KateRaworth) November 18, 2021

Here is a savage review:

And here is an academic review:

Paul Erlich’s ‘The Population Bomb’ warned that we would be unable to feed a growing global population and that the solution was to reduce birthrates. He said “we can no longer afford merely to treat the symptoms of the cancer of population growth; the cancer itself must be cut out”. Suggested methods included adding sterlients to the food supply (see Ritchie 2024, p.155). That didn’t happen, but fears about overpopulation were so influential it led to the sterilisation of 8 million Indian men. And yet as of January 2023 Paul Erlich is still receiving media coverage when warning about unsustainable growth. Note:

As the lecture argues, we are more than capable of providing good living standards for the population. And if you are worried about an exponential population growth then don’t be. Population growth has fallen from over 2% in the 1960s to 0.8% by 2022. We have now passed “peak child”, with the highest number of children peaking in 2017. The global population is expected to stabilise at 11bn. It turns out that when you are successful at reducing poverty people tend to have fewer children. We have sufficient natural resources as well as the socio-economic system necessary to support a thriving global population. Like John Lennon, we do not need to be concerned about over population:

John Lennon “Overpopulation is a myth” 1971 pic.twitter.com/WINj8iEUYG

— Historic Vids (@historyinmemes) January 30, 2023

| Lecture handout: Sustainability Survey |

Recently there has been increased attention to the concept of “degrowth”. I think it’s important to recognise that we simply don’t have sufficient wealth for everyone to have a reasonable standard of living. Even if you somehow confiscated the entire global GDP and shared it equally everyone would only get $15 per day. ($84 trillion between 8 billion people is $10,695 which is $30 per day. This is a reasonable income for many parts of the world, but would lock us in to present consumption power. Would you have wanted your parents to have made a similar trade back in 1985, which would be $12 trillion between 5 billion = $2,400, i.e. less than $7 per day? I’ve used income, rather than wealth, because the data is better. These figures should also be adjusted for purchasing power, but it’s only meant as a back of the envelope exercise).

In addition to this, growth is one of the biggest parts of the solution to our environmental problems. This is because:

An academic article published in 2024 provides a comprehensive survey of 561 articles from the degrowth literature. It found that: “the large majority (almost 90%) of studies are opinions rather than analysis; few studies use… data… most studies offer ad hoc and subjective policy advice… various studies represent a “reverse causality” confusion, i.e. use the term degrowth not for a deliberate strategy but to denote economic decline (in GDP terms) resulting from exogenous factors or public policies; [and] few studies adopt a system-wide perspective – instead most focus on small, local cases without a clear implication for the economy as a whole.”

See: Ivan Savin, Jeroen van den Bergh, 2024, “Reviewing studies of degrowth: Are claims matched by data, methods and policy analysis?“, Ecological Economics, Volume 226

I also recommend the following:

Recommended books

Recommended podcasts

| Learning Objectives: This session considers whether infinite growth is possible on a planet with finite natural resources.

Spotlight on sustainability: Doh! |

This course will develop students capacity for economic analysis and awareness of the most important insights for management.

This course will develop students capacity for economic analysis and awareness of the most important insights for management.

Evans, Anthony J., 2020 “Economics: A complete guide for business“, London Publishing Partnership

Digital copies of the relevant section are available in the links below.

| Session | Before | During | After |

| 1. Incentives Matter | Nothing | Lecture handouts |

|

| 2. Markets: Beyond AI | Watch the full movie Arrival (2016), Denis Villeneuve

You can download all of the above in a single PDF file here. |

Lecture handouts | |

| 3. Market Applications |

|

Lecture handouts |

|

| 4. Competition and the Market Process |

|

Lecture handouts

|

|

| 5. Global Prosperity | Activity: Global conditions quiz | Lecture handouts | |

| 6. Growth | Watch “Growth is like an iPhone”

|

Lecture handouts |

|

| 7. Sustainability |

|

Lecture handouts | |

| 8. Inequality | Activity: Thinking about wealth

Watch: “$456,000 Squid Game In Real Life!” Mr Beast Watch the full movie Parasite (2019), Bong Joon Ho

|

Lecture handouts |

Do you ever copy and paste an online essay into a word document, delete the photos, resize the text, print out a hard copy, find a pub in a strange city, order a pint of beer and a Jack Daniel’s, put in some earbuds to dampen the noise, and relax? I do.

Here are a collection of slightly longer newspaper articles that I’ve found absorbing and well worth reading:

For more of this genre, see Best of 2023: Personal Essays.

It’s 15 years since my first trip to Belgrade. Here’s a collection of cultural artifacts that have contributed to my understanding of, and affection for, Serbia.

The most important books in terms of history and culture, are:

The Belgrade panorama:

The Belgrade phantom:

In 2019 I went to the Belgrade derby for the second time, and British YouTuber Thogden was also there. If you look carefully you might spot me in the crowd

This NBA documentary showing the importance of basketball:

https://www.youtube.com/watch?v=0LCvOy7QHf8

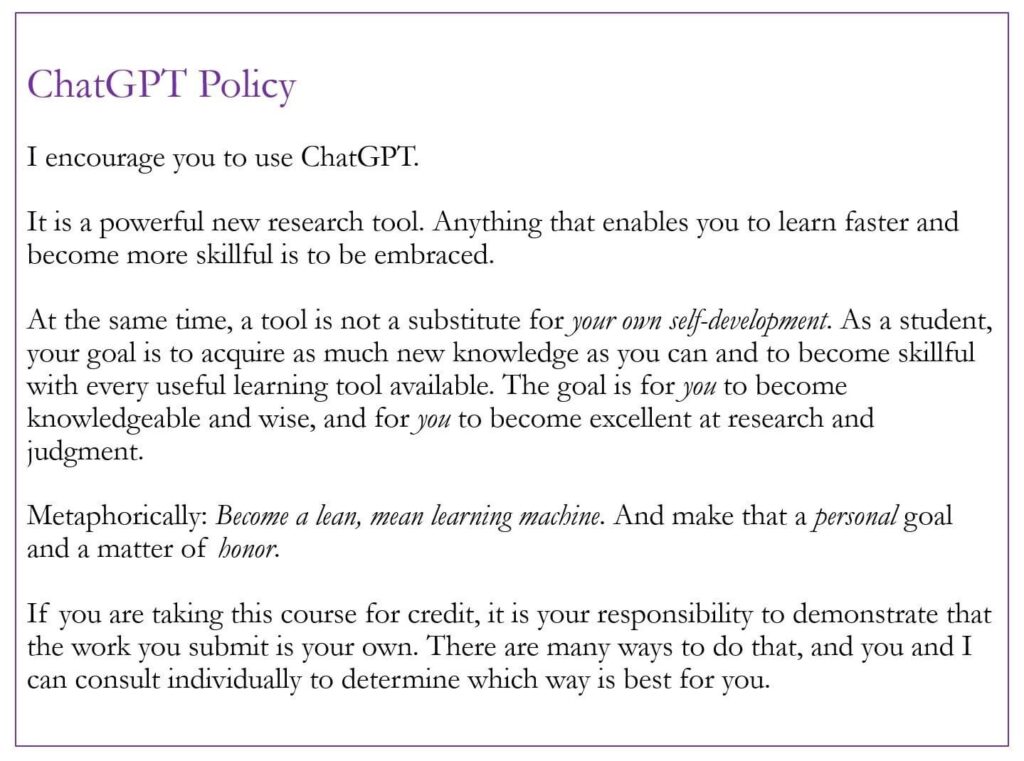

My policy on Generative AI (such as ChatGPT, Claude, or other other Large Language Models (LLM)) is a simple one:

Treat AI as a helpful person, such as a parent or friend.

***

What does this mean for class attendance?

❌ You are not allowed to ask it to attend class and take notes for you.

I can understand that having a parent or friend attend class with you to take notes might help your learning, but there are already policies in place for students that face difficulties with meeting basic expectations. Such requests should be made in advance and solutions found that take into consideration students that are capable of doing their own note taking. There is also a proprietary issue whereby class materials are not supposed to be made public or used for AI training purposes. In the same way that we don’t record live sessions, we don’t invite outsiders unless there’s a specific pedagogical reason.

What does this mean for studying?

✅ You are allowed to ask it questions for revision purposes.

❌ You are not allowed to upload course materials.

Course materials are proprietary content and unless explicitly stated should not be used outside of the classroom.

What does this mean for written assessments?

✅ You are allowed to ask it questions.

✅ You are allowed to get advice on writing.

❌ You are not allowed to submit any text that it generates as your own work.

❌ You are not allowed to submit any text into another piece of software that rewrites it.

The issue here is attribution and accountability. An attribution of authorship carries with it accountability for the work, which cannot be effectively applied to Generative AI. When you submit a piece of assessment the aim is to establish your unique understanding, as opposed to the understanding of someone else. This means that while you can use a wide variety of inputs to provide help, any output needs to be generated, and “owned” by yourself.

If you have found a way to automate your work, such that anyone (or anything) else can follow the steps that you take and create the same output, you have succeeded in finding efficiencies. You have possibly even generated important knowledge. But you have failed to complete the assignment you were set. Your formal assessment is intended to establish your ability, as a human, to complete the task. Formal assessment is not intended to establish your capability to use technology to meet an objective. That is why submitting other people’s work (whether it’s your parents, your friends, or from Generative AI) is fraud.

An inaccurate analogy would be to treat Generative AI like software, such as Microsoft Word. It is obviously not cheating to type answers in a word processor, or use spelling or formatting advice to improve your work. Unlike Word, however, Generative AI goes beyond helping your writing to actually help with content. Also, the fact that you can use an integrated spell checker is a function of an assignment being digital. If it is a handwritten essay then you may be permitted to use a dictionary, but you may not. A finance exam may permit a formula sheet, it may not. A maths exam may permit a calculator, it may not. There are all choices made by the instructor based on the learning objectives of the course. If standard software becomes integrated with AI this may blur the line, but as things stand it seems clear to me that using AI remains a choice and therefore its use should be related to the instructors objectives.

It is clear that assessment design needs to be updated due to AI. But not because anything has fundamentally changed – contract cheating has always been a problem. It’s just that the costs have become so much lower the practice has become much more widespread. And I see no difference in the need for an exam policy for AI than having one for Whatsapp. Both are communication tools. Both are outlawed.

| Examples of good assessment methods in an age of AI include: | |

| Restrict AI | Recognise AI |

|

|

Generative AI is more of an oracle than a piece of software, which is why I think it’s better to imagine it as a helpful person. Or, as Cowen and Tabarrok (2023) say in this very useful article about how to use ChatGPT,

“It resembles collaborating with a bright and knowledgeable research assistant, albeit one from a different culture.”

I also recommend developing some custom instructions. Here are Eli Dourado’s.

I recommend this article:

And I like this graphic:

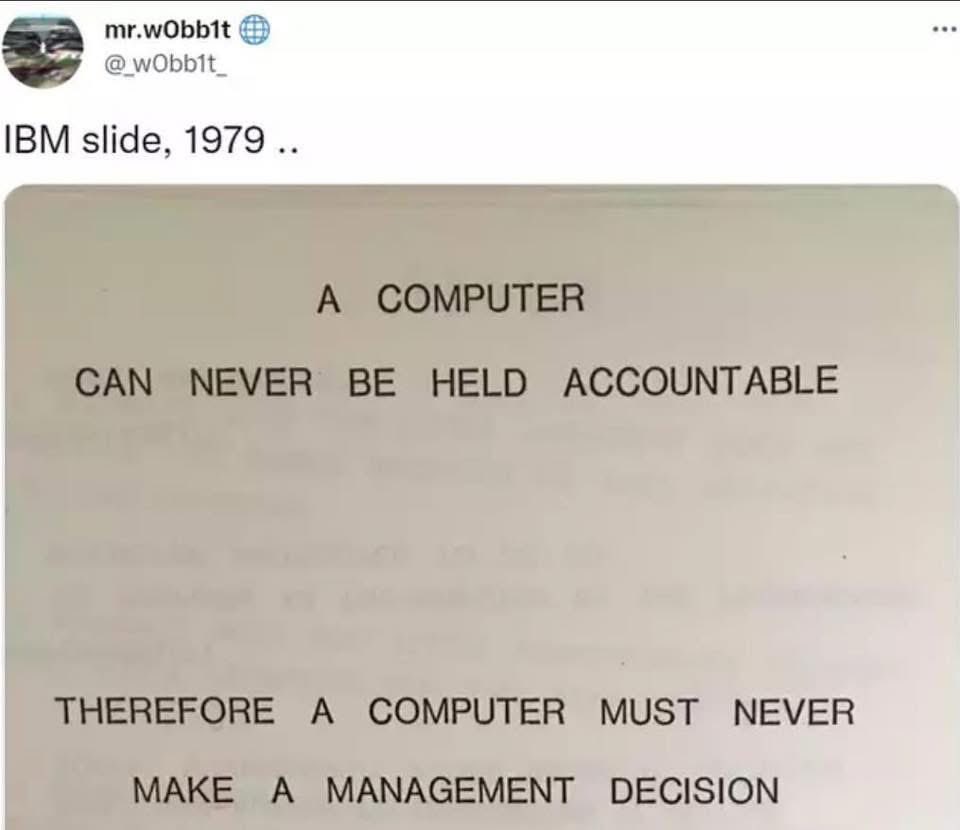

What does this mean for management?

❌ AI should NOT be used for management decisions. Again, it comes down to accountability.

What does this mean for a thesis?

If you decide to use Generative AI in your thesis you should be honest and open about it, and provide an appropriate discussion in the Methods section (or, if a Methods section is not used, a suitable alternative part) of the manuscript. That will allow your advisor and committee to establish whether your use is appropriate. If you decide to use Generative AI but don’t explain how, this is fraud. In some cases, it may be that use of Generative AI is so heavy it warrants being a co author. This is fine if you list Generative AI as a co author, and you can do this for other types of work, but a thesis or other formal assessment must be single authorship.

Finally, ethical behaviour is important. Therefore:

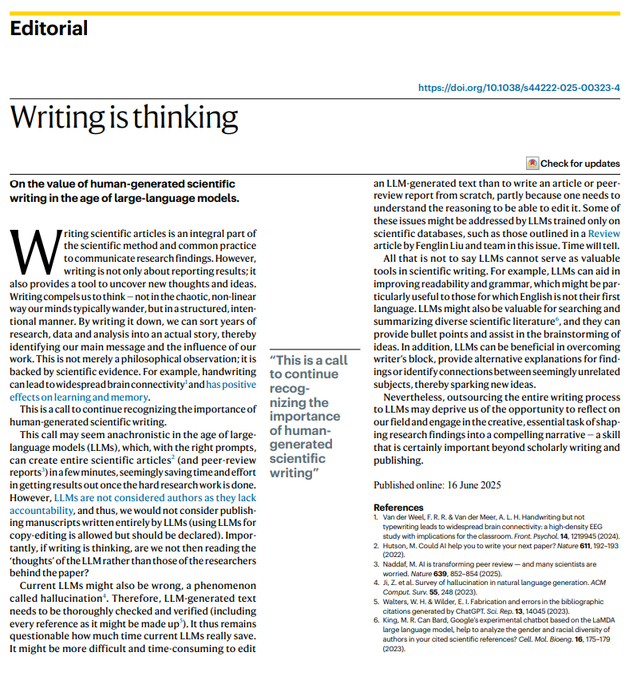

Writing is thinking. So don’t cheat yourself:

Don’t forget that the original excitement about AI was how quickly and easily it helped mediocre students imitate good students. If this is your situation then I can understand why it is an exciting tool. But I am more interested in your personal development than your ability to mimic others. Therefore I resist pressure towards conformity and advocate authentic work that is accountable. I prefer Human Authenticity over Artificial Intelligence.

Updated September2025