Stagnation

| Activity: Transformative Innovations |

| Lecture handout: Stagnation* |

⭐ Required readings:

- Eichengreen, Barry, 2015, “Secular Stagnation: The Long View.” American Economic Review, 105 (5): 66-70

- Thierer, Adam, “How Many Lives Are Lost Due to the Precautionary Principle?” The Bridge, expert commentary, October 2019

Watch “Steve Jobs – iPhone Introduction in 2007” (the first 17 minutes is sufficient)

Recommended audio:

- Are we running out of ideas? Freakonomics, November 2017 – the key points are to consider whether productivity is happening but isn’t being captured by GDP due to spillovers

- The End of Invention, BBC Radio 4, March 2022 (see this post for links and more discussion)

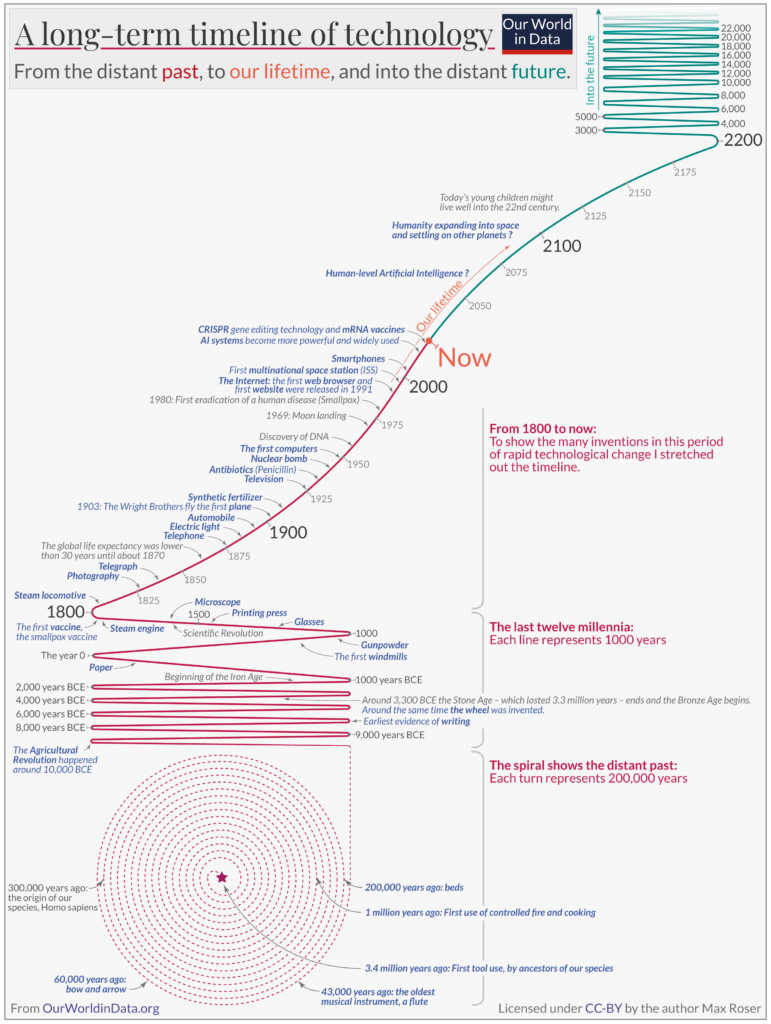

According to Max Grossman, as of 2021 half of all scientific papers that had even been published had come in the last 12 years, and yet much less than half of scientific progress had happened in that same period.

Here’s a great image showing a long-term timeline of technology (but notice the gap between smartphones and Now):

Here is a video showing the opening of the Empire State Building:

And don’t forget just how amazing it was when people saw the iPhone for the first time:

For more on whether Jeanne Calment really was the oldest person ever, see Wikipedia. Saul Newman is a demographer who has found that the places that have lots of people living over the age of 100 tend to be riddled by clerical errors and pension fraud – he won an Ig Nobel in 2024. This chart shows that once birth certificates became widely adopted far fewer people claimed to be very old.

Here is The Economist on how claims of people living to a great age decline when birth certificates are introduced.

As Alec Strpp says, “Areas of the world with people claiming to be 110+ years old are actually just places with poor record keeping and a lot of pension fraud.”

As Alec Strpp says, “Areas of the world with people claiming to be 110+ years old are actually just places with poor record keeping and a lot of pension fraud.”

Isn’t it weird how you used to be able to easily tell when a TV series was set from the fashion? And yet long running recent shows are much harder to date. For example,

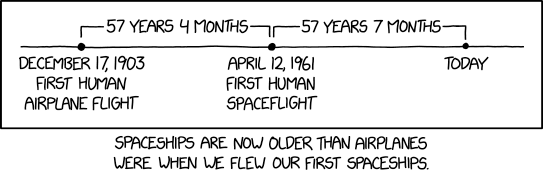

I was saddened to learn recently that same amount of time had passed between the first human airplane flight and the first human spaceflight as between the first spaceflight and 2018 (see here).

Here is a good defense of the importance of aviation:

“It has offered people the opportunity to migrate from one country to another It lets them return home to visit their families. It has provided jobs. Driven innovations in new technologies. It has made our societies more diverse and multicultural and has allowed us to experience the beauty of other countries. these are experience I want everyone in the world to have access to” (Ritchie, 2024, p.99)

To some extent this lecture is about trying to work out what happened in the early 1970s. This website poses the same question:

Some interesting (and possibly related) facts about this period:

And here are some iconic photos from 1974.

Perhaps, in future, people will look back on 2007 and say “what happened??”

The way we talk about “wtf happened in 1971”, future generations will talk about “wtf happened in 2007” pic.twitter.com/iqDl4LS3G0

— Nabeel S. Qureshi (@nabeelqu) May 19, 2023

The lecture provided some pessimistic views on transformative breakthroughs. But every now and then I notice the power of steady, incremental progress. For example:

Noah Smith has a nice Twitter thread on progress since 1970.

40 years of improved precision engineering and execution speed https://t.co/pDLGbeeqAN

— Roberto Alonso González Lezcano (@robertoglezcano) February 2, 2020

This website: My Ordinary Life: Improvements since the 1990s

And here’s a great video showing the progress made in car passenger safety:

If you found the point about complacency convincing, see

- Cowen, Tyler, “Ten Ways to Live a Less Complacent Life”, LinkedIn, May 2017

Finally, a lot of the themes from this session was covered in a quarterly report that I wrote for Kaleidic Economics over 10 years ago!

- “Welcome to the Great Stagnation” Kaleidic Economics, March 2014

| Learning Objectives: Understand the scholarly literature on the secular stagnation thesis |

Course introduction

Course introduction