The Great EU Debt Write Off

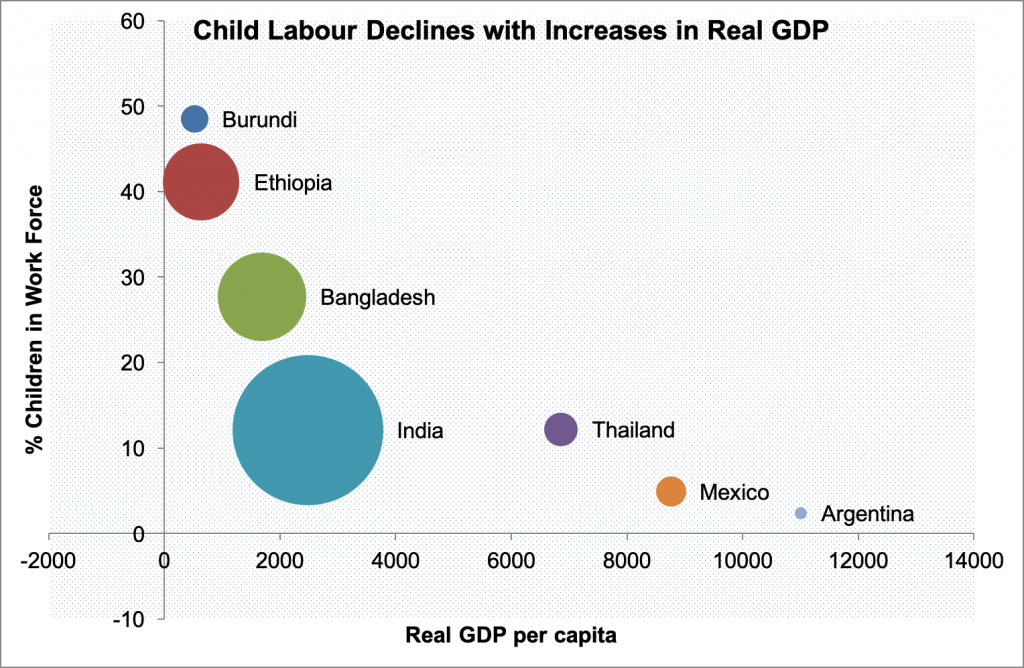

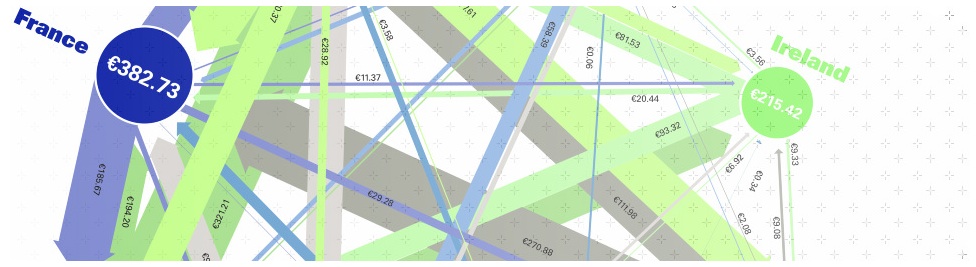

This page presents the results of a simulation conducted by students at ESCP Business School. The aim was to uncover the amount of interlinked debt between Portugal, Ireland, Italy, Greece, Spain, Britain, France, and Germany; and then see what would happen if they attempted to cross cancel obligations.

The results were fascinating:

- All countries can reduce their total debt by 64% through cross cancellation of interlinked debt, taking total debt from 40.47% of GDP to 14.58%

- Six countries – Ireland, Italy, Spain, Britain, France and Germany – can write off more than 50% of their outstanding debt

- Three countries – Ireland, Italy, and Germany – can reduce their obligations such that they owe more than €1bn to only 2 other countries

- Ireland can reduce its debt from almost 130% of GDP to under 20% of GDP

- France can virtually eliminate its debt – reducing it to just 0.06% of GDP

The formal study has been published by the journal Simulation and Gaming.

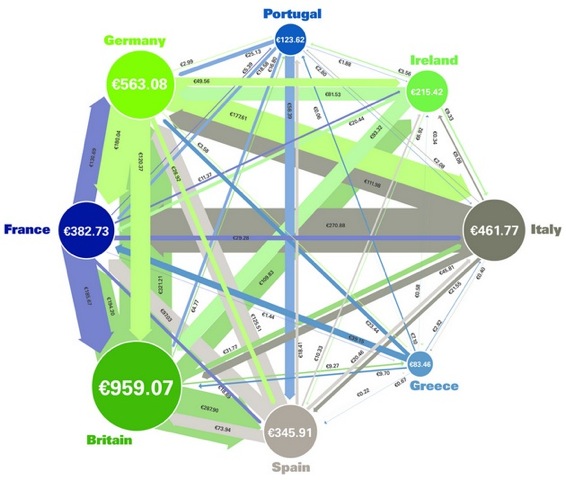

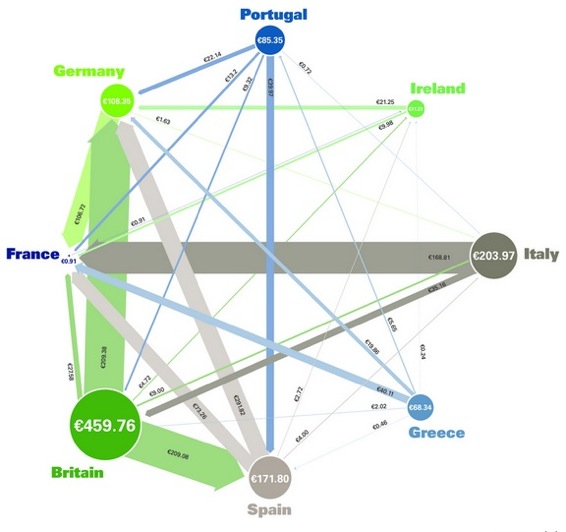

Here is the before and after:

Images by Soapbox

The idea

The idea is very simple – if Portugal owes Ireland €0.34bn of short term debt, and Ireland owes Portugal €0.17bn, we can write off Ireland’s obligations and leave Portugal with a reduced debt of €0.17bn.If you are both a debtor and a creditor you do not need money to settle claims. Rather than require additional funds to deal with choking debt, why not write it off?

The diagrams above show the before and after situation, based on analysis done by students. The simulation itself took place on May 17th 2011 and involved three separate trading rounds.

Students in the Pre-Masters Year of the ESCP Europe Masters in Management program took part in the trial run on March 22, 2011, which involved only the PIIGS countries. The key results were the following:

- Portugal was able to cut its debt in half, primarily because so much of that debt was held by Spain.

- Ireland reduced its debt by 99.74%, mostly through deals with Spain and Portugal. It was able to make use of trading period 3 by moving short- and medium-term debt into long-term debt.

- Italy had a weak bargaining position, as it began with the worst debt position (a high concentration of short-term debt). After reducing debt by 50% in period 1, it was unable to make further gains.

- Greece reduced its debt by 11% but mostly because it had little exposure to the other PIIGS countries. It was unable to make any trades after period 1.

- Spain managed to eliminate all of its debt obligations to the other PIIGS countries, although it owed significant amounts to Britain, France, and Germany. Spain found that it could deal with everyone at the table quite equally.

Main data sources

Resources for instructors

If you would like to replicate this simulation in your classroom, download this zip file. It includes:

- All of our data (including sources and notes)

- The starting positions for each country

- The results table to provide real time information to students

- A summary sheet for students to complete each round

Further reading

- “Europe’s Web of Debt” New York Times, May 1st 2010

- “Ireland & Greece: The Numbers” Wall Street Journal, November 21st 2010

- “How to stop Ireland’s financial contagion”, by Wolfgang Munchau, Financial Times, November 21st 2010

- “Europe’s financial contagion”, by Neil Irwin, Washington Post, December 3rd 2010

- “Eurozone debt web” BBC News, November 18th 2011

Media coverage

- City AM

- Zero Hedge

- Financial Times Alphaville

- Talous Sanomat

- Radio Ireland’s NewsTalk

- BBC Radio 2

- Interview with Terence Tse

For more details or media enquiries please contact Anthony J. Evans.