Student FAQs

1. Why don’t you take attendance at the start of class?

The first 15 minutes of the class are very important and I do not want to devote them to administrative tasks. I also want to pretend that you turn up to learn something, and not purely because you require proof of being present. You are expected to be present for the entire duration of the session and therefore it shouldn’t matter when I take attendance, but I normally do so at the start of the break. It is your responsibility to ensure that you are marked as present before leaving the class.

2. Why don’t you make all of the content from your lecture slides available?

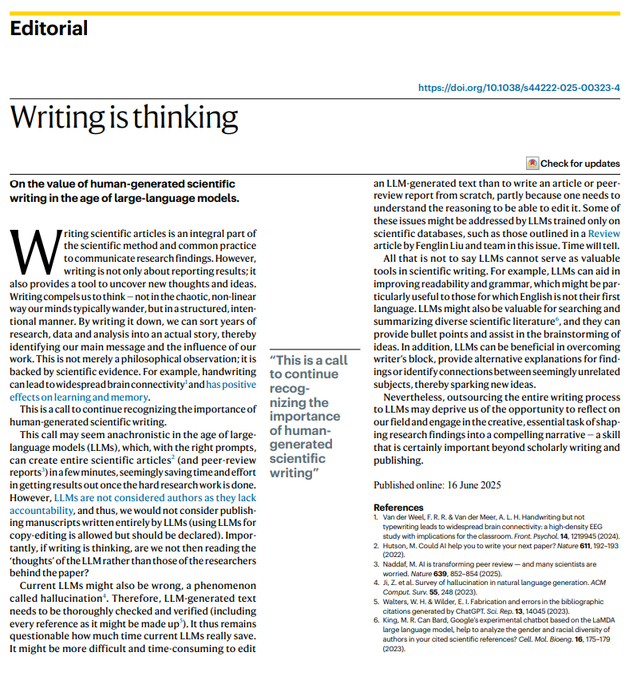

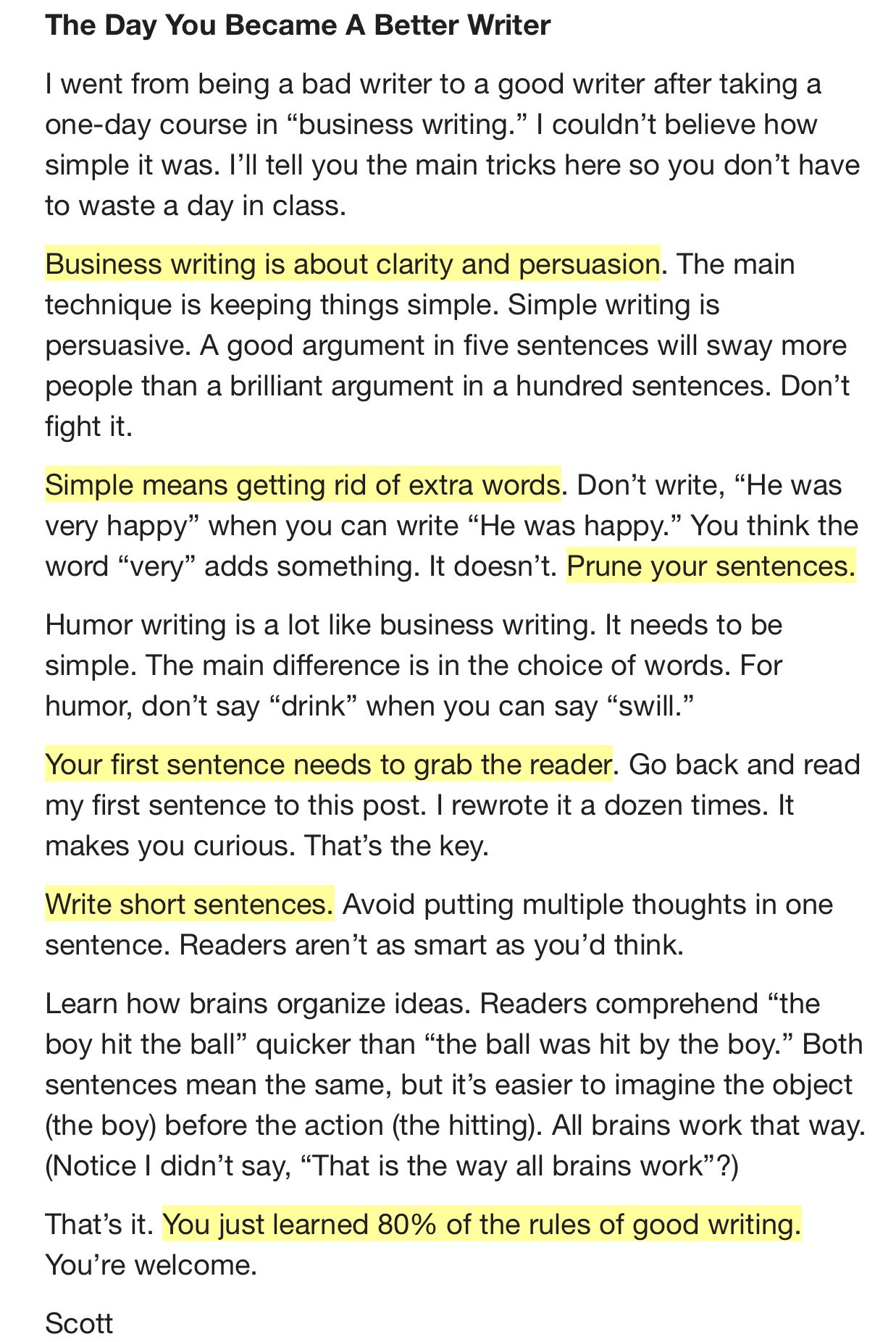

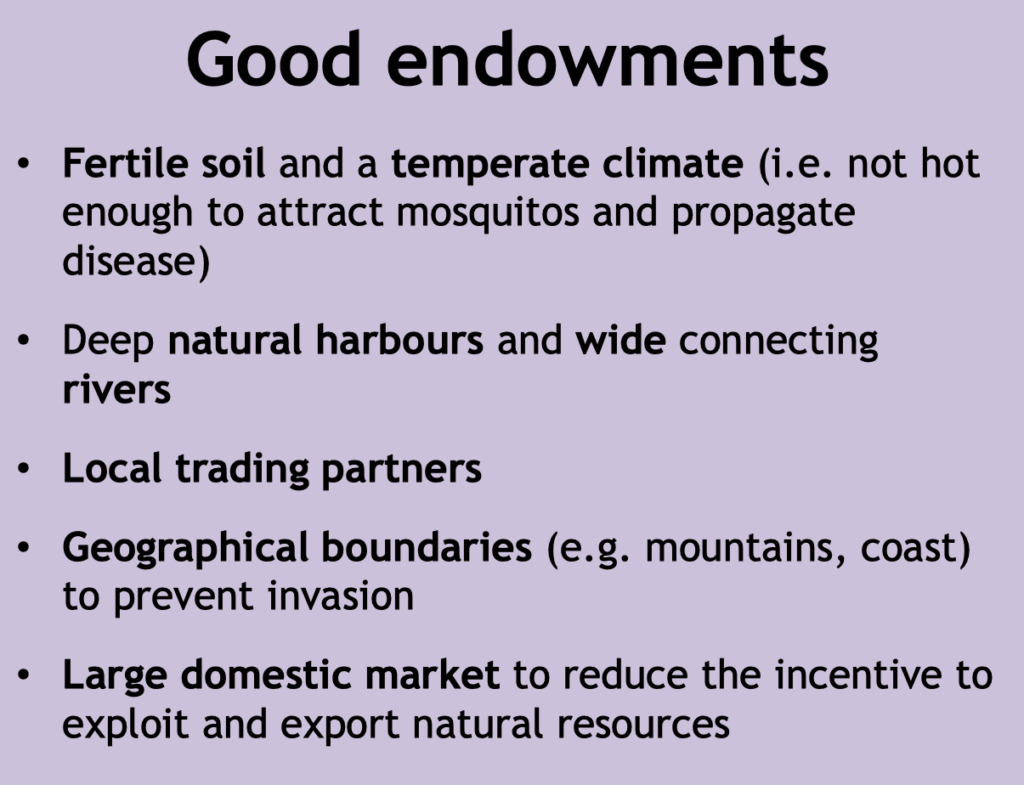

As a professional educator one of my main concerns with the prevalence of digital content is the impact it has on a student’s ability to gather, synthesize, and critically engage with content. I try to ensure that all of my live sessions are unique and generate content that requires attention and consideration. For this reason I strongly encourage students to take notes, and debrief with group members, instead of relying on the provision of solutions, punchlines, or board plans at some future date. There are three types of powerpoint content that I reveal in class and aren’t visible in the PDF lecture handouts. They are either:

- Answers – these are intended to be a surprise and therefore I don’t want you to be able to see them in advance.

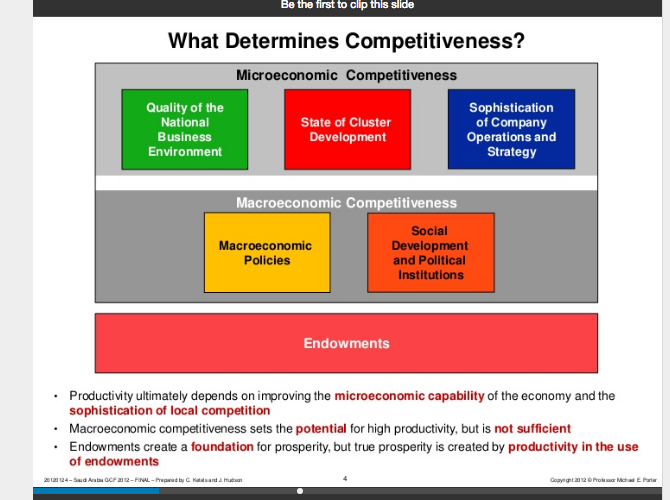

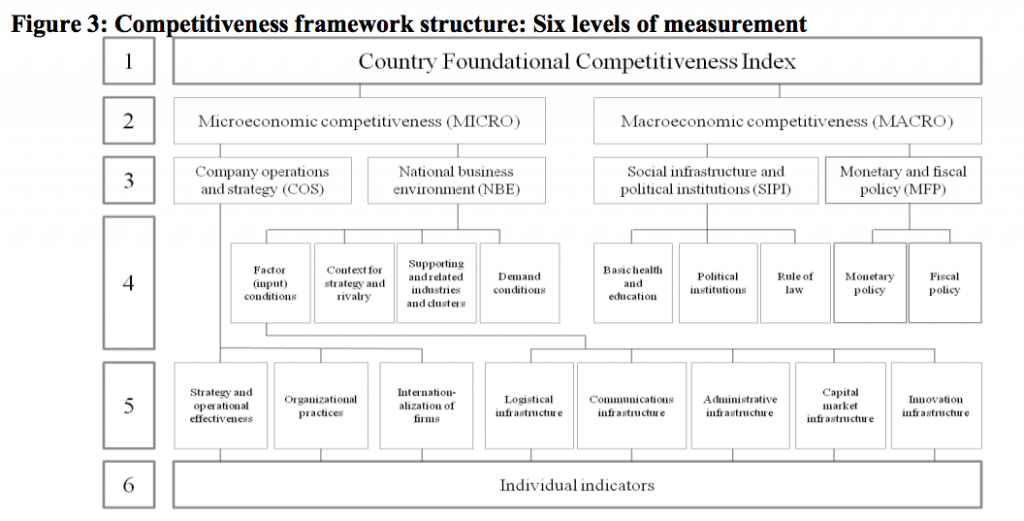

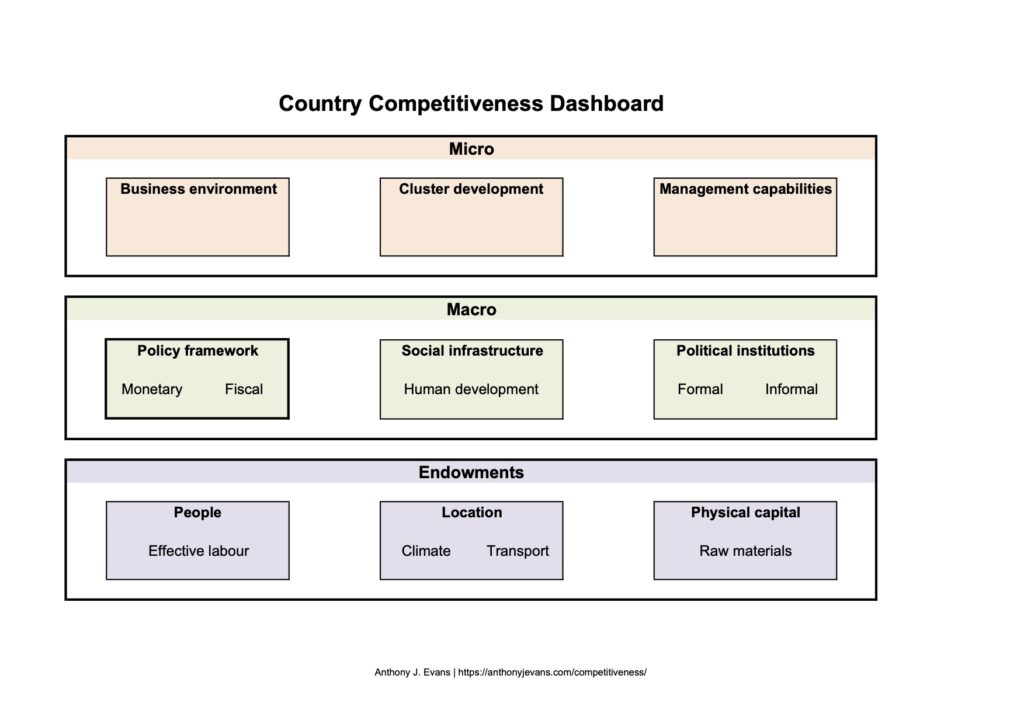

- Images – for design reasons these often can’t be simultaneously shown alongside the text, and would also use a lot of ink if printed.

- Confidential information – in these cases I don’t want the material to potentially circulate on the internet.

You should therefore treat this information the same as something I write on the whiteboard or say verbally, where the burden is on you to take notes rather than rely on handouts. Recognising what is pertinent and what is not is a key part of your obligations as a learner. This is also a reason why student attendance is important, since there is a necessity to be present in class to receive all of the necessary information. For the same reason that I don’t provide copies of my whiteboard plans or recordings of class, some powerpoint content is deliberately restricted.

Rest assured that I pay close attention to what is and isn’t within the PDF handout. If it is something relevant for an exam then it will be easy for you to fill in the gaps. If the information is relevant, but not necessarily important, you will be able to find out more either through a footnote or the additional resources on my website. In any case, if you feel that you didn’t capture some relevant information, whether it was communicated via powerpoint, on the whiteboard or verbally, just let me know and I’d be happy to help your revision. Part of my responsibility as an instructor is to ensure that you do not finish the course missing any important information. But your responsibility as a student is to be in charge of absorbing what happens in the classroom.

3. Why don’t you provide a word count or expected number of pages for assignments?

Because then I would also need to provide guidance on font size and other details that detract from your ability to establish, for yourself, an appropriate length and format.

4. What is an “open book” final exam?

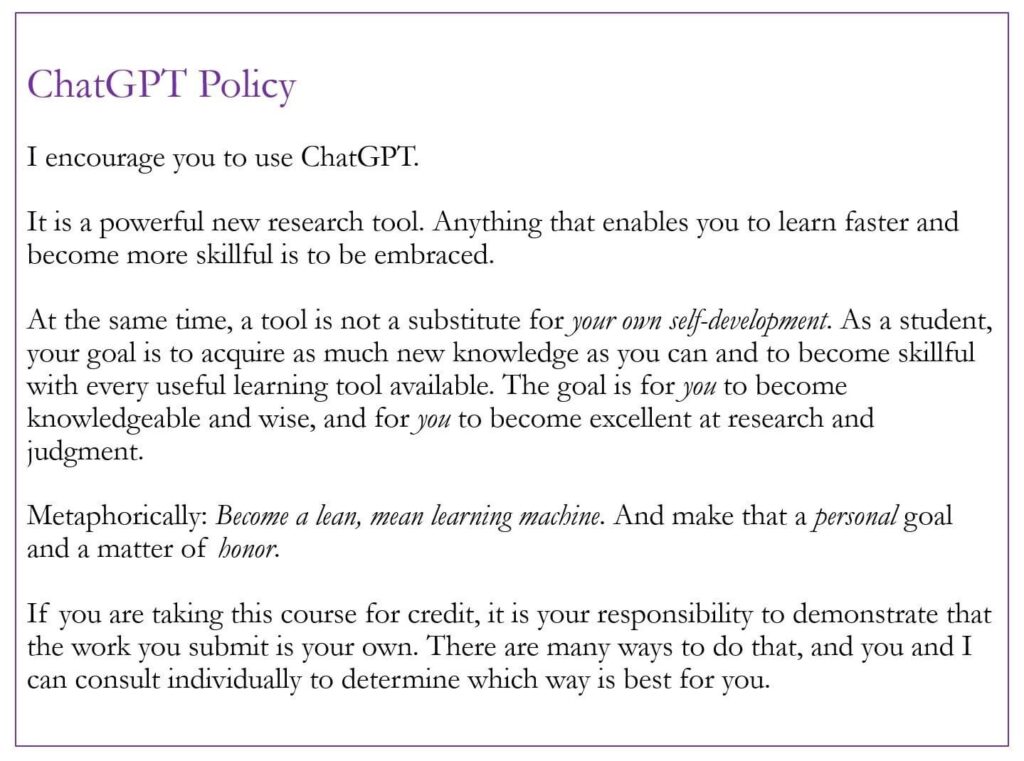

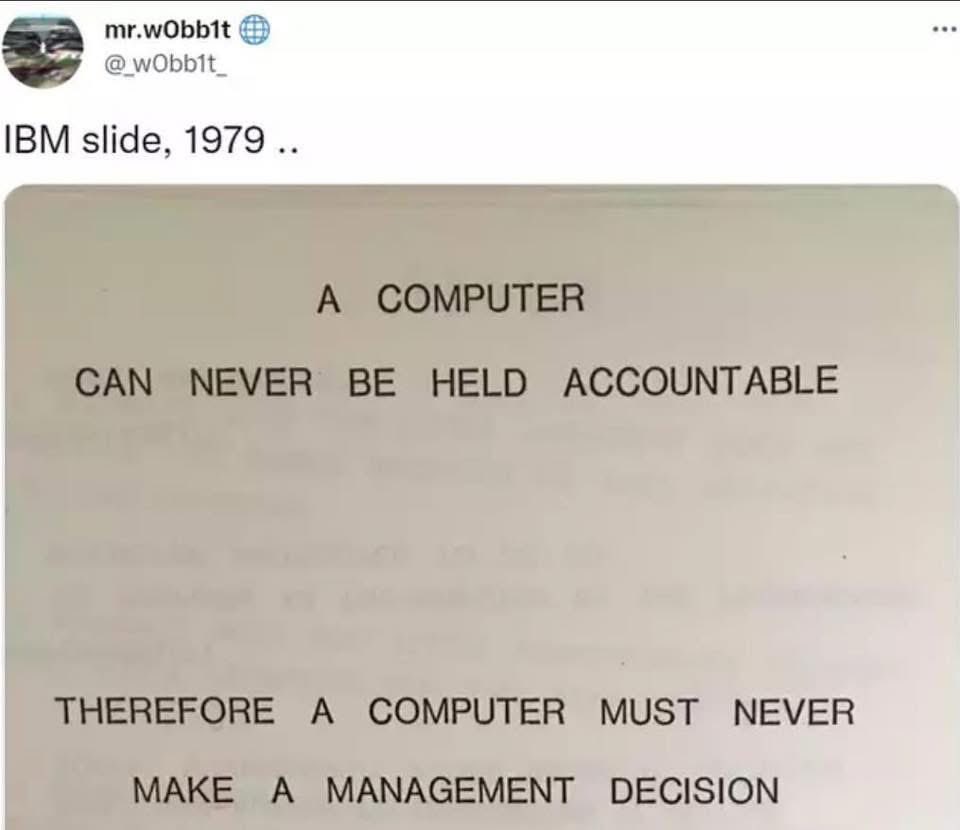

You will take the exam on your own laptop and are allowed to consult any notes. The exam is “open book” in the sense that you can use course materials. However, you may not use your laptop (or any other electronic device) to communicate with anyone (e.g. another student or a LLM such as ChatGPT). The purpose of the exam is to test your knowledge of the content, rather than your ability to use the internet to find answers to questions. Therefore obtaining help from someone/anything else during an exam (whether it’s a fellow student or an AI) is a serious offense and will result in disciplinary action. You can use your device to access course materials. You may not use it for communication.

5. How do I get full marks on a MCQ?

For full marks you need to select all of the correct answers. Depending on the intended difficulty level and the software being used it may not be obvious how many of the provided answers are correct. This is to ensure that you consider each one carefully. Partial credit will be available in some instances.