Montalbert

We have a 2 bedroom apartment in the family-friendly ski resort of La Plagne Montalbert. It has a master bedroom and a smaller bunk room making it perfect for a family of 4, and the sofa bed in the lounge means that it can cater for 6. Located on the second floor, the balcony overlooks the piste and provides hours of entertainment and afternoon sun.

How to get there

❇️ Montalbert is a 2 hour drive from Lyon or just over 2 hours from Geneva. Both airports are served by low cost flights with usual car rentals available. ✈️

❇️ Aime station is at the bottom of the valley (11km away), and easy to reach either by taxi (15 minutes) or a regular bus service (via Altibus). During the ski season there are often direct trains from St Pancras, however return journeys depart from Bourg-St-Maurice, which is twice as far from Aime (this is because only Bourg has the security equipment that allows it to have international passengers). A good option is to get a standard Eurostar to France and then change for a TGV to Aime. There is a regular (and cheap) service from Paris Gare du Lyon but – top tip – you can also change at Lille, which means you avoid having to cross Paris! For more see the Man in Seat 61.

❇️ We are 976km from Calais which is around 9 hours of driving. It can be done in one day, but France has plenty of clean and affordable hotels at convenient stops along the way (we use Novotels). The toll roads are fast and efficient and it’s much more pleasant to drive through France than the UK. There are two ways to reach Calais:

❇️ ️There are regular and cheap ferry services from Dover, from £80 per trip (see P&O or DFDS) ⛴️

❇️ The Eurotunnel (now known as Le Shuttle) is usually around £140 but takes just 35 minutes and goes from Folkestone.

❄️ Winter

La Plagne is world famous for its size and array of runs. Best suited for all rounders and families, there are enough black runs to challenge serious skiers but the main places are accessible via blue runs. Best of all the Vanoise Express connects La Plagne with Les Arc, providing over 400km of ski runs, 70% of which are above 2,000ft. There are also 18 separate “fun zones” and new activities and lifts are added each year.

Image: https://en.la-plagne.com/discover/ski-area/piste-map

☀️ Summer

Montalbert is a charming mountain village which makes it a suitable place to vacation all year round. Outside of the ski season there are plenty of amenities and the summer wildflowers are stunning. The gondola still operates and this allows walkers to reach the higher mountains. Mountain bikers can take ski lifts up several runs and enjoy the descent. For more see this summer guide, or a trail map for Mont Jovet.

Photo: https://www.savoie-mont-blanc.com/en/walking/mont-jovet-loop-146925/

How to book

You can check availability or make enquiries through all the usual platforms. And the cheapest way is to book direct with Montalbert Ski.

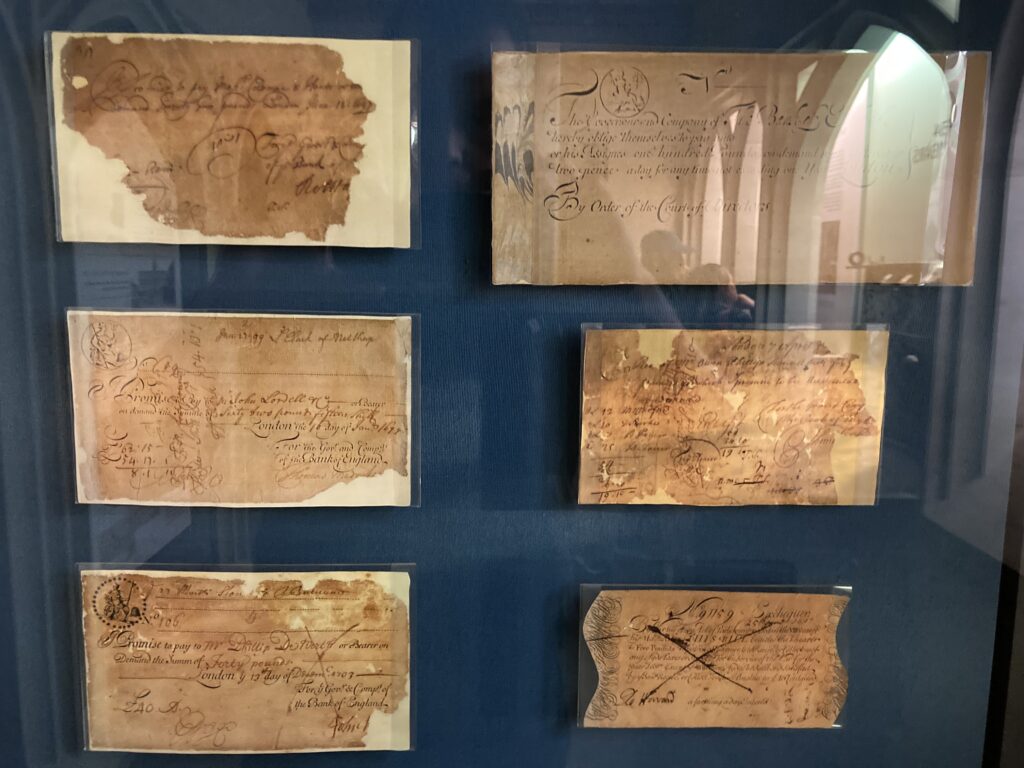

Notice how some are torn in the bottom corner. As

Notice how some are torn in the bottom corner. As