Central banks and digital transformation

| Lecture handout: Central banking and digital transformation* |

We are seeing unprecedented innovation in payment technologies, with disruptive firms encroaching on activities that many think should be left to central banks. But why not think creatively about the opportunities and threats from decentralised money? What is the proper role of a monetary authority in a system that is fit for the twenty first century? This lecture equips students with the skills to take a radical look at contemporary issues that relate crypto currencies and central bank activities.

Prerequisite: I assume that you have some familiarity with basic concepts from money and banking, and know about and understand Blockchain and Bitcoin. If you don’t, see here:

Key readings:

- “What is central bank digital currency (CBDC)?“, McKinsey, March 1st 2023

- “Central banks, the monetary system and public payment infrastructure: lessons from Brazil’s Pix” BIS Bulletin No. 52, March 23rd 2022

Recommended podcasts:

- “Larry White on stablecoins and CBDCs”, Macro Musings, August 2021

- “George Selgin on Bitcoin and CBDCs”, Macro Musings, October 2021

Current policy relevance:

- “Money and payments: The US dollar in the age of digital transformation” Board of Governors of the Federal Reserve System, January 2022

- “Central bank digital currency: opportunities, challenges and design“, Bank of England, March 12th 2020 [PDF here] – also see “The digital pound” which is a collection of resources, including a Technology Working Paper and a Consultation Paper

In response to the 2022 Fed paper, George Selgin wrote a briefing paper that advocated expanding the set of providers that the Fed deals with, to obtain the competition and innovation that comes from the private sector without the Fed having to issue their own digital currencies. Stablecoin issuers do not require the same regulatory oversight as traditional banks, by providing access to the Fed’s system they simply need to ensure that they fully back their coins with central bank reserves (and possibly short term Treasury certificates). This would require:

- Bank licenses should be available to non-traditional banks (i.e. institutions that don’t do all of the activities typically associated with a bank, such as maturity transformation)

- The Fed should allow fintech companies to have master/settlement accounts (which the Bank of England did in 2018)

- For more see: Selgin, G., “A ‘narrow’ path to efficient digital currency”, Cato Briefing Paper No. 134, February 9th 2022

Other country case studies

- India: Kearns, J., and Mathew, A., How India’s central bank helped spur a digital payments boom, IMF October 27th 2022

- Nigeria: “Riots erupt in Nigerian cities as bank policy leads to scarcity of cash“, The Guardian, February 15th 2023

- Kenya: see this press release, concluding that “implementation of a CBDC may not be a compelling priority… in the short to medium term”

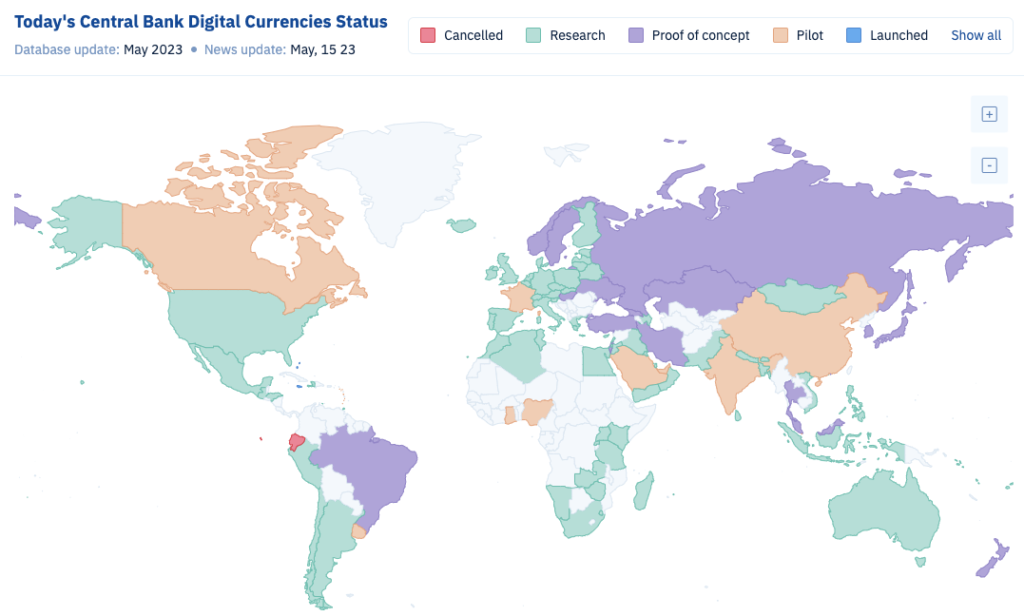

Here’s a website that keeps track of interest in CBDCs around the world:

Here is a good article summarising various CBDC experiments:

- Dowd, K., 2024, “So far, Central Bank Digital Currencies have failed” Economic Affairs,

| Learning Objectives: Provide an assessment of central bank responsibilities in the digital currency landscape.

Cutting edge theory: Assessing current policy relevance of central bank activities. |