Policy

I have contributed to a number of policy debates and have received notable coverage in the following areas:

- Competitiveness and entrepreneurship policy

- Flat taxes, corporation tax and public finance

- NGDP targets and free banking

My work on nuclear energy, and the potential role of SMR’s for Croatia, was covered by Open Access Government. And my advice on competitiveness was presented in a joint conference with the Minister of Finance.

My call for the Bank of England to abolish the Monetary Policy Committee was covered on the front page of the The Daily Telegraph and City AM and prompted an invitation to give a guest lecture to the Bank’s staff. I provided a comprehensive proposal for the UK to adopt nominal GDP targeting and it was covered by Forbes, CNBC, Bloomberg, Moneyweek, and discussed on Bloomberg TV.

You can read my 2017 submission to the Treasury Select Committee here.

I served on the 2020 Tax Commission which advocated a single income tax, and won the $100,000 2013 Templeton Freedom Award. My back of the envelope calculations on the counter intuitive idea that corporation tax harms workers was featured on Page 3 of The Sun, and contributed to the fact that from 2012-2017 the UK government cut it from 28% to 19%. This coincided with revenues rising by 44%. In September 2022 the government decided to keep corporation tax at 19%, for more see here.

Policy reports

“What happened in Belarus?” GCRF COMPASS Policy Brief, 25 November 2021

“Harnessing nuclear power to meet Croatia’s energy needs” Energy Management Centre Working Paper No. 32, July 2020

- Submitted to the lead project coordinator for the International Atomic Energy Agency Technical Cooperation Project RER2017, July 2020 (for some background see here).

- Covered by Open Access Government, January 22nd 2021 (see here)

“A Belarus Monetary Perspective” Markets and Money Advisory, March 2018

“Monetary Policy After the Crash” Adam Smith Institute, February 2018

- Op ed: “Monetary policy is outdated. Here’s how to reboot it” Daily Telegraph, February 15th 2018

- “Bank of England inflation target should be replaced by nominal GDP says free-market think tank” City AM

- “Bank urged to dump target for inflation” The Times

- “Economist tells government: Scrap 2% inflation target” Mark Williamson, The Herald

- “the Bank of England needs credibility more than ever” Evening Standard (my response)

“Sound Money: An Austrian proposal for free banking, NGDP targets, and OMO reforms” Adam Smith Institute, 2016

- Buy a hard copy here.

- Download the spreadsheet here.

- Download the press release here.

- “New paper: Sound Money: an Austrian proposal for free banking, NGDP targets, and OMO reforms” Adam Smith Institute, 11th January 2016

- “Ben Southwood discusses ASI paper “Sound Money” on Bloomberg TV“, 14th January 2016

- “Scrap Bank of England’s powers after century of boom and bust, says think-tank” Peter Spence The Telegraph, 11th January 2016

- “Adam Smith Institute (ASI) wants to get rid of the Bank of England’s Monetary Policy Committee (MPC) and replace it with a rule tied to nominal GDP“, Lauren Fedor, City AM, 11th January 2016

- “BOE Should Use GDP Data to Set Monetary Policy, Institute Says“, Simon Kennedy, Bloomberg, 11th January 2016

- “Bank of England should be stripped of monetary policy powers, Adam Smith Institute says” Bauke Schram, International Business Times, 11th January 2016

- “Could this be the new model for central banks?” Katy Barnato, CNBC, 11th January 2016

- “Think tank: “Togliete poteri alle banche centrali”” Daneile Chicca, Wall Street Italia, 11th January 2016

- “ASI: Let’s Change The Bank Of England, In Fact, Let’s Abolish Central Banking” Tim Worstall, Forbes.com, 11th January 2016

- “Austrians get (some) mainstream credibility” Alasdair Macleod, GoldMoney Insights, January 14th 2016

- “Should we abolish the Bank of England?” Simon Wilson, MoneyWeek, January 23rd 2016

- Republished in Capital & Conflict, January 16th 2016

“In Search of Austerity: An Analysis of the British Situation” Mercatus Center, October 2012

- “Austerity U.K. Edition, Part 2” National Review Online

- “a new and very good paper”, Tyler Cowen, Marginal Revolution, October 25th 2012

“The Single Income Tax” 2020 Tax Commission, May 2012 [I served as a commissioner]

- Winner of the 2013 Templeton Freedom Award

- “Business backs single income tax rate of 30%”, Financial Times

- “Boost growth with 30pc flat rate, Osborne told”, Daily Telegraph

- “Plan for 30% levy and end of stamp duty; The single tax rate”, The Times

- “Tax shake-up urged to empower consumers and kick-start growth”, The Independent

- “The Tax Reform Britain Needs”, Wall Street Journal Europe

- “Calls for single 30% tax rate”, Daily Mail

- “Tax cuts ‘booster'”, The Sun

- “Demand for tax shake-up to aid recovery”, Sunday Express

- Also covered by Sky News, BBC Two’s Daily Politics, BBC News Channel, ITV News.

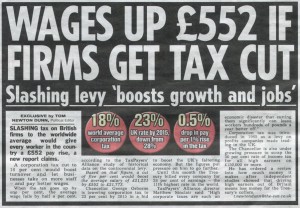

“Corporation Tax” 2020 Tax Commission Briefing Note, April 2011

- “Osborne remains rhetoric-heavy, action-light“, Pete Spence, City AM, April 2nd 2013

- “Corporation Tax would boost wages: report“, Ed Kemp, City AM, April 26th 2011

- “Wages up £552 if firms get tax cut”, Tom Newton Dunn, The Sun, April 25th 2011

- Also covered on Page 3

- Impact: in 2008 the rate of corporation tax was 28%. In 2011 successive UK governments started to reduce it, firstly to 26% and then to 24% in 2012, 23% in 2013, 21% in 2014, 20% in 2015, and 19% in 2017. During this period tax revenue rose by 44%. The experience during the 2010s is that lower rates coincided with higher revenues. See here for more.

“Public Attitudes to Banking” The Cobden Centre, June 2010

- “The scary truth about your banks and your savings” Edmund Conway, The Daily Telegraph, June 10th 2010

“2 days, 2 weeks, 2 months: A proposal for sound money” The Cobden Centre, June 2010

“Enterprising Britain: Building the enterprise capital of the world” (with Davide Sola and Adina Poenaru), independent report for the Conservative Party, February 2008

See the interim report, published in October 2007, here.

- “Labour’s ‘lasting damage to entrepreneurs’” Philip Aldrick, The Daily Telegraph, February 5th 2008

- “Osborne’s chance to scrap our Soviet rules” Margareta Pagano, The Independent on Sunday, January 13th 2008

- “Tax system ‘is making UK less competitive’” Margareta Pagano, The Independent on Sunday, January 13th 2008

- “Will soaring oil pump up inflation?“ David Smith, The Sunday Times, October 21st 2007

- “Report piles pressure on Darling over capital gains tax“ Hélène Mulholland and agencies, The Guardian Unlimited, Oct 18th 2007

- “Gordon Brown supporter urges delay for capital gains tax changes” Greg Hurst and Philip Webster, The Times, Oct 18th 2007

- “Osborne vows fight to keep taper relief on capital gains tax” Gabriel Rozenberg, The Times, Oct 18th 2007

- “Why Labour is no longer the darling of British enterprise”, Jeff Randall, The Daily Telegraph, Oct 17th 2007

- “Rising taxes and red tape ‘slowing growth’” Richard Tyler, The Daily Telegraph, Oct 17th 2007

“Are Tesco Acting Competitively?” (with Toby Baxendale), submitted to the Competition Commission, December 2007 [Groceries Market – Third Party Submissions]

“Sharpening the Thinking on the UK Audit Industry”, submitted to the Financial Reporting Council, May 2006 [Responses to Discussion Papers]